This week's HighLevel updates, explained for mortgage professionals. We cut through the noise and tell you what actually matters for your business, what you can ignore, and what to set up right now.

If you've been trying to make sense of HighLevel's growing list of AI tools, this Weekly Breakdown brings some much-needed clarity. After two weeks of non-stop feature drops, this week's rollout focuses on smarter training, cleaner builder experiences, and a better (but still clunky) Ask AI assistant. Whether you're building funnels, managing reviews, or just looking to save time in your CRM, there's something here to make your system faster and more usable.

Let's dig into the ten most relevant updates for HighLevel users in mortgage and real estate.

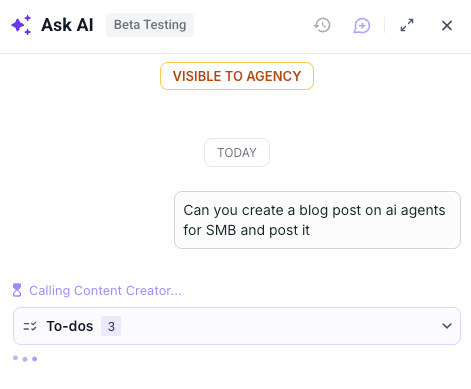

Ask AI Gets a Facelift

What Changed: Ask AI now features a redesigned UI with a cleaner, more guided experience on mobile and desktop. The update introduces a step-by-step campaign flow for building marketing assets like emails.

Why It Matters for LOs:

Easier to understand what Ask AI is trying to do

Looks more polished for client-facing demos

Still limited in functionality and often off-target

Tip: Use this only for quick tests or inspiration. It's not ready for full campaigns.

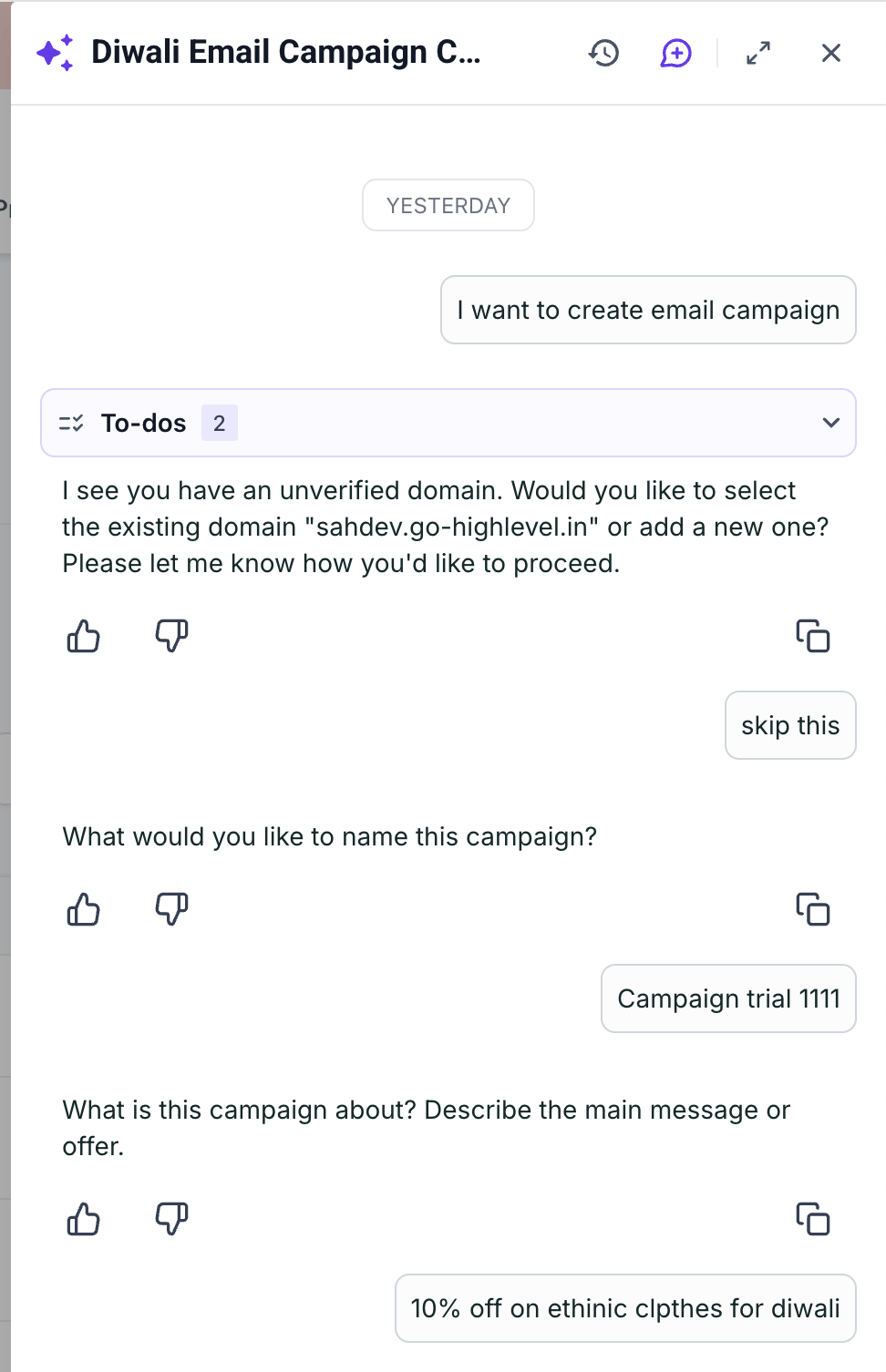

New Campaign Builder Inside Ask AI

What Changed: You can now launch an email campaign workflow directly from Ask AI. It walks you through questions about your offer, audience, and tone.

Why It Matters for LOs:

Saves time writing basic outreach sequences

Not well-aligned with mortgage-specific needs yet

Often misunderstands prompt context (e.g., adds lead magnets when you didn't ask for them)

Tip: Skip this for now. The native Email Builder offers a better experience.

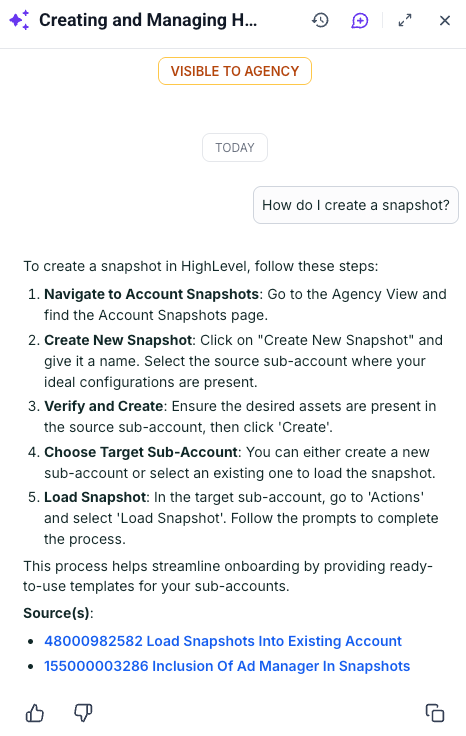

Ask AI Can Now Read Your Knowledge Base

What Changed: Ask AI is now trained on your own Knowledge Base content. It can use uploaded docs, FAQs, and pasted text to inform its answers.

Why It Matters for LOs:

Gives more accurate, relevant responses

Helps onboard new team members quickly

Can be used to simulate client-facing chatbot logic

Tip: Keep your KB clean and updated with plain language. The smarter the content, the better the AI.

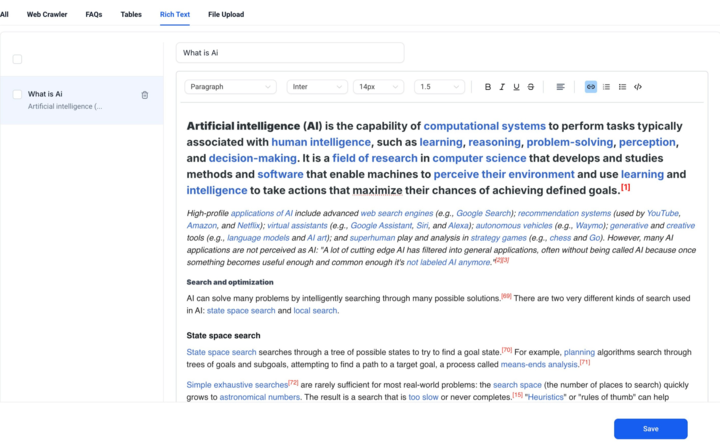

Richer Content in Knowledge Base

What Changed: You can now paste rich text, create tables, and upload DOC, DOCX, PDF, and CSV files into the Knowledge Base.

Why It Matters for LOs:

No need to convert files before uploading

Organize product info, loan guidelines, and training docs in one place

Support for structured data means better chatbot logic

Tip: Use tables to build comparison charts for loan types or programs.

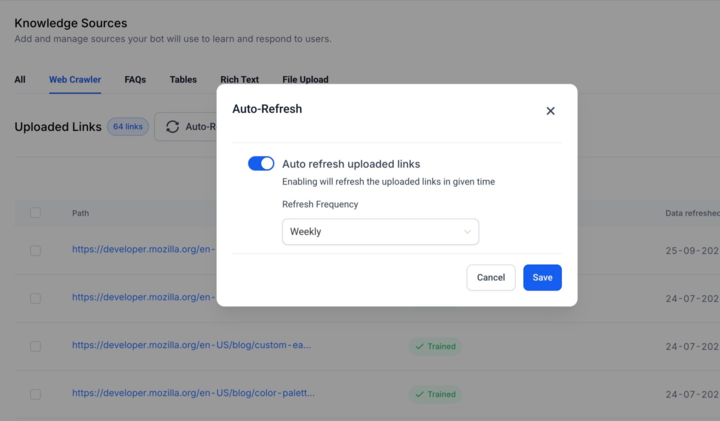

Auto-Refresh for Web Content

What Changed: You can now set external web URLs added to the Knowledge Base to auto-refresh daily, weekly, or monthly.

Why It Matters for LOs:

Keeps your AI assistant trained on the latest content

Great for referencing constantly updated industry sources

Reduces manual re-uploading of links

Tip: Use this with your own website or trusted mortgage news sources.

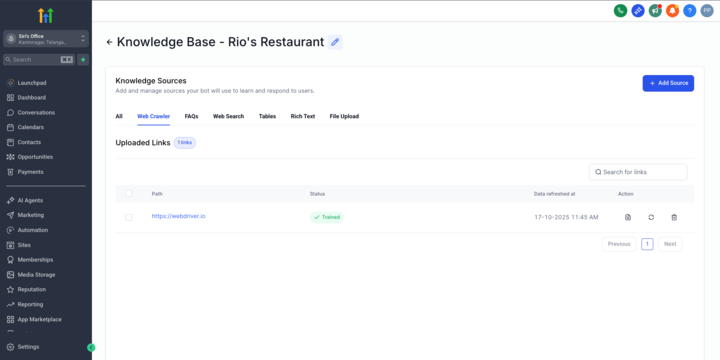

Improved Web Crawler

What Changed: The web crawler used to train your Knowledge Base now better parses and pulls content from URLs. It's also easier to set up.

Why It Matters for LOs:

Scrapes useful info without needing to upload files

Ideal for adding mortgage FAQs or product descriptions

Helps keep your support content centralized

Tip: Test pages before finalizing the crawl to avoid irrelevant text.

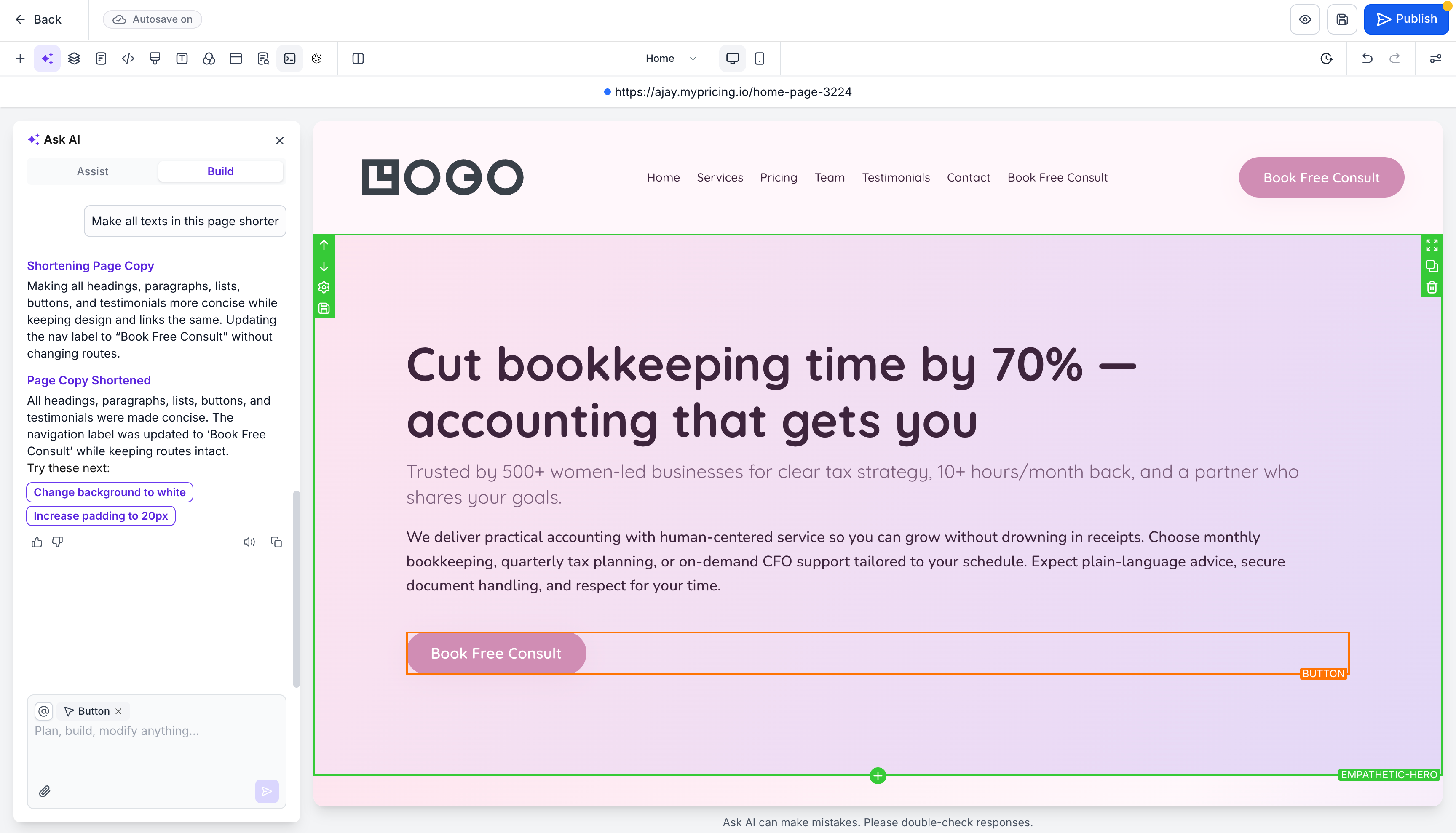

Funnel Builder AI Returns

What Changed: The AI Funnel Builder is back with a smoother setup flow. It allows you to define your tone, audience, and offer, then generates funnel pages automatically.

Why It Matters for LOs:

Build draft funnels in minutes

Faster page structure for things like loan program promos or open house signups

More intuitive than Ask AI

Tip: Generate the base funnel, then refine it manually in the page builder.

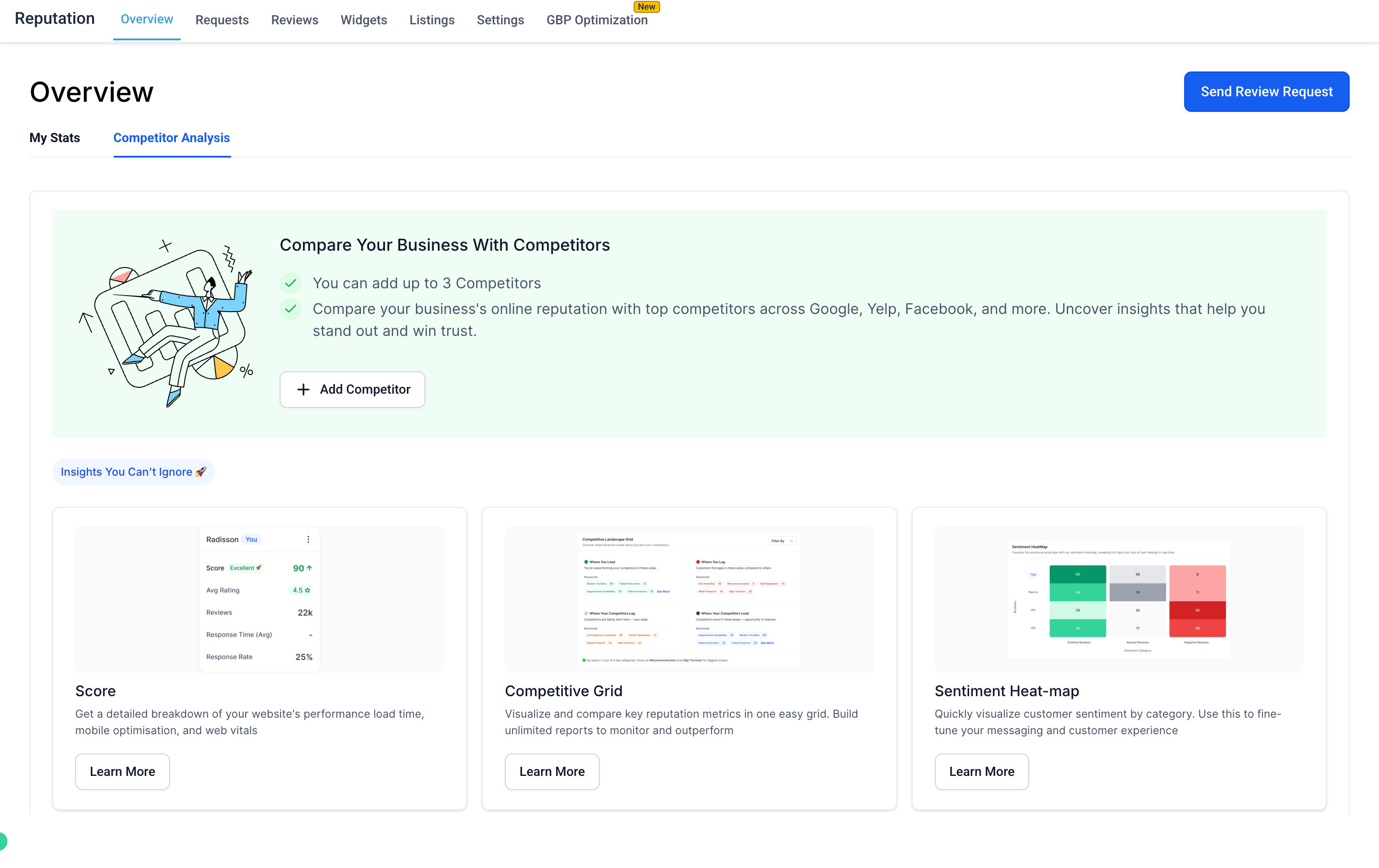

Competitor Analysis in Reputation Manager

What Changed: You can now compare your reviews with local competitors inside the Reputation tab. This includes sentiment analysis, strengths and weaknesses, and a visual heatmap.

Why It Matters for LOs:

See how your branch stacks up in the market

Spot areas for improving client experience

Gather competitive talking points

Tip: Use this in marketing reviews or strategy meetings with your team.

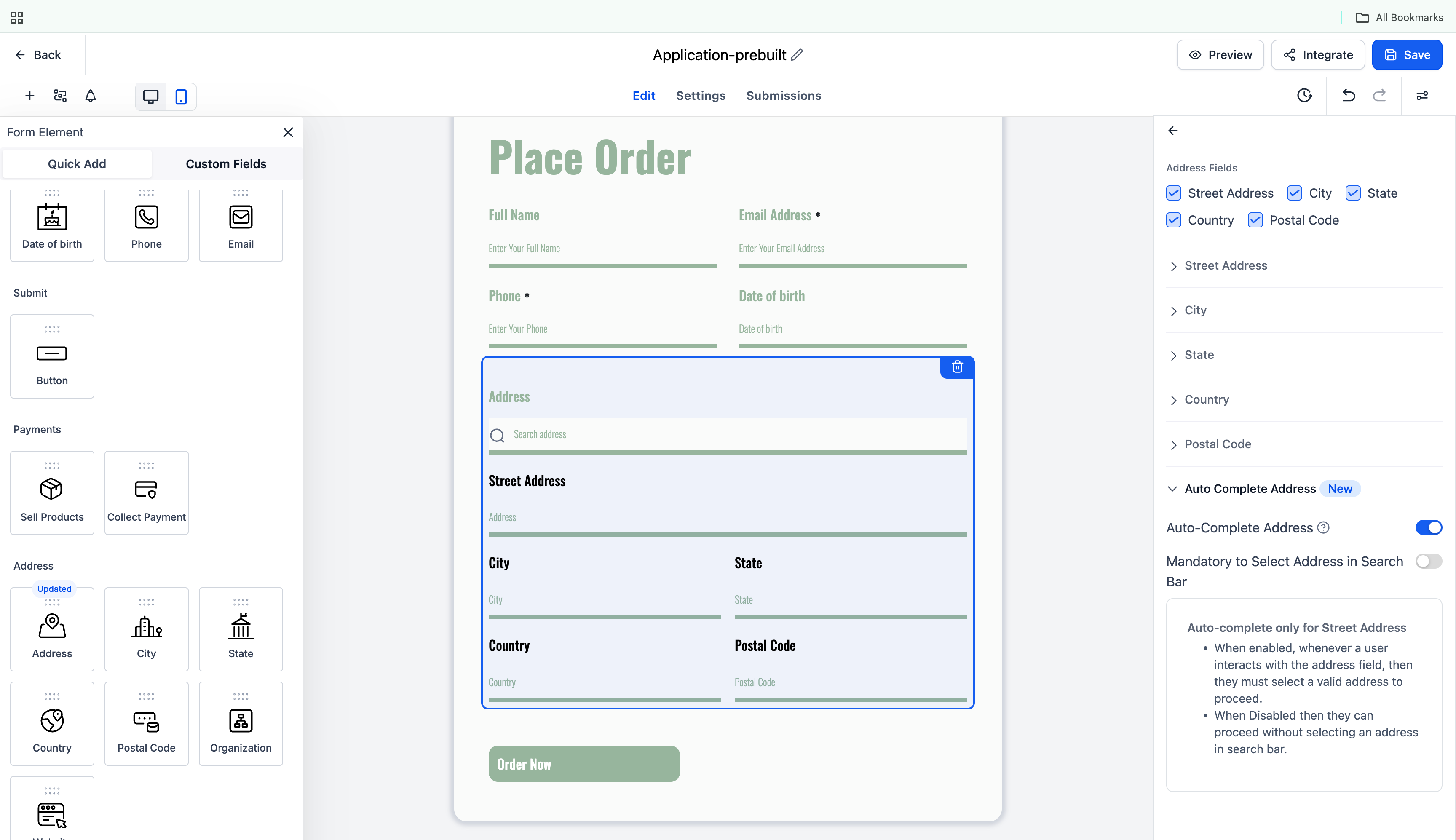

Address Autocomplete Now Built-In

What Changed: The address field in Forms and Surveys now includes autocomplete by default. No more enabling it manually in agency settings.

Why It Matters for LOs:

Clean, standardized address data for lead routing

Less manual input for users at open houses or on mobile

Works great for "What's my home worth" forms

Tip: Replace your old address fields with the new version to enable autocomplete.

Why These Updates Matter for Mortgage Pros

If you're using HighLevel to run a mortgage business, these updates help you:

Train your CRM faster with content you already have

Build funnels and emails in less time with smarter AI tools

Standardize lead capture with clean address inputs

Compare your reviews with local competitors in a few clicks

Stay up to date without constantly re-uploading docs or links

The more you streamline your systems, the more time you can spend where it counts, following up with leads, closing loans, and creating better client experiences.

🎥 Watch the Full Weekly Breakdown

After two weeks of nonstop releases, this week brings focused upgrades that help you move faster and build smarter. From AI tools that actually work to cleaner automations and better training workflows, every update this week is built for how mortgage teams use HighLevel day to day.

👉 Watch the full video to see how these upgrades fit into real workflows.

🔔 Join the HL4 Community for insider tips and early access: joinhl4.com

Want to Go Deeper?

Join the HL4MP Community to hang out with other loan officers, see real setups, and get behind-the-scenes access to what is working in HighLevel right now. Or Go Pro for $97/mo to get hands-on help in weekly Office Hours.