This week's HighLevel updates, explained for mortgage professionals. We cut through the noise and tell you what actually matters for your business, what you can ignore, and what to set up right now.

This week's Weekly Breakdown is all about tightening up how you use HighLevel. No new tools to learn. No dramatic redesigns. Just practical updates that make your day move smoother.

Whether you're tagging calls, cleaning up your Instagram feed, switching between workflows, or syncing tasks with your ops team, these updates touch the spots that get used the most. They don't scream for attention, but they make a difference you'll feel after a single login.

Less tab-jumping. Fewer workarounds. Cleaner client-facing content. These are real improvements for mortgage teams who live inside the platform every day.

Let's dig in.

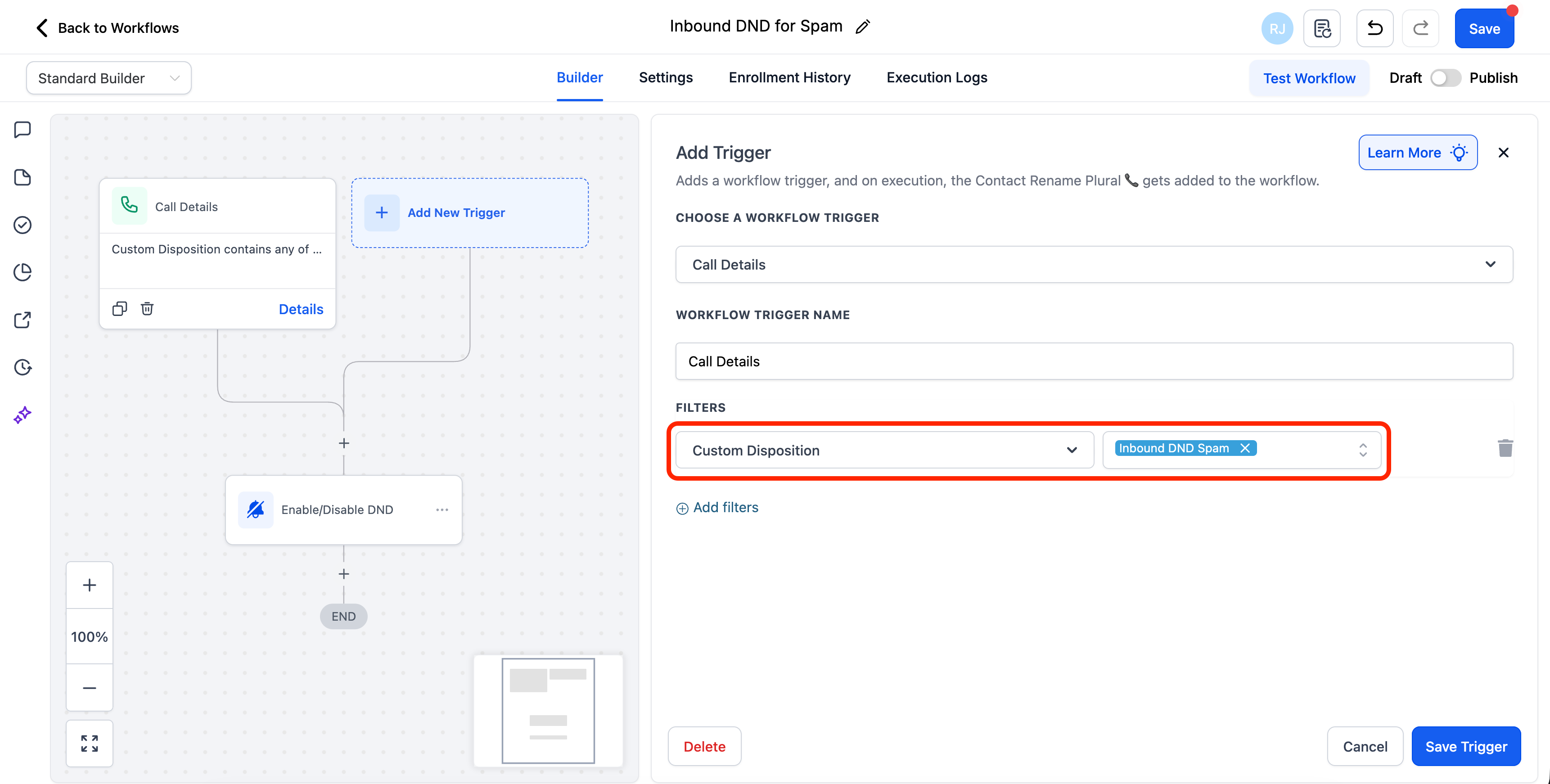

Create Custom Call Dispositions

What Changed

You can now set up custom call outcomes in the HighLevel dialer and use them to trigger specific workflows.

Instead of being stuck with vague default options like "Voicemail" or "Follow-Up," you can build your own list that matches your process. Use outcomes like:

"Send App Link"

"Call Realtor"

"Docs Requested"

"Credit Pull Needed"

Each one can fire a workflow, apply tags, or move a contact to a different stage.

Why It Matters for LOs

This update turns your dialer into an actual workflow launcher. You can track intent more precisely, automate next steps, and remove ambiguity from your team's follow-up. It also tightens up pipeline reporting since every call now reflects a real outcome.

Tip: Use different disposition sets for lead follow-up, agent outreach, or borrower updates so each call type feeds the right flow.

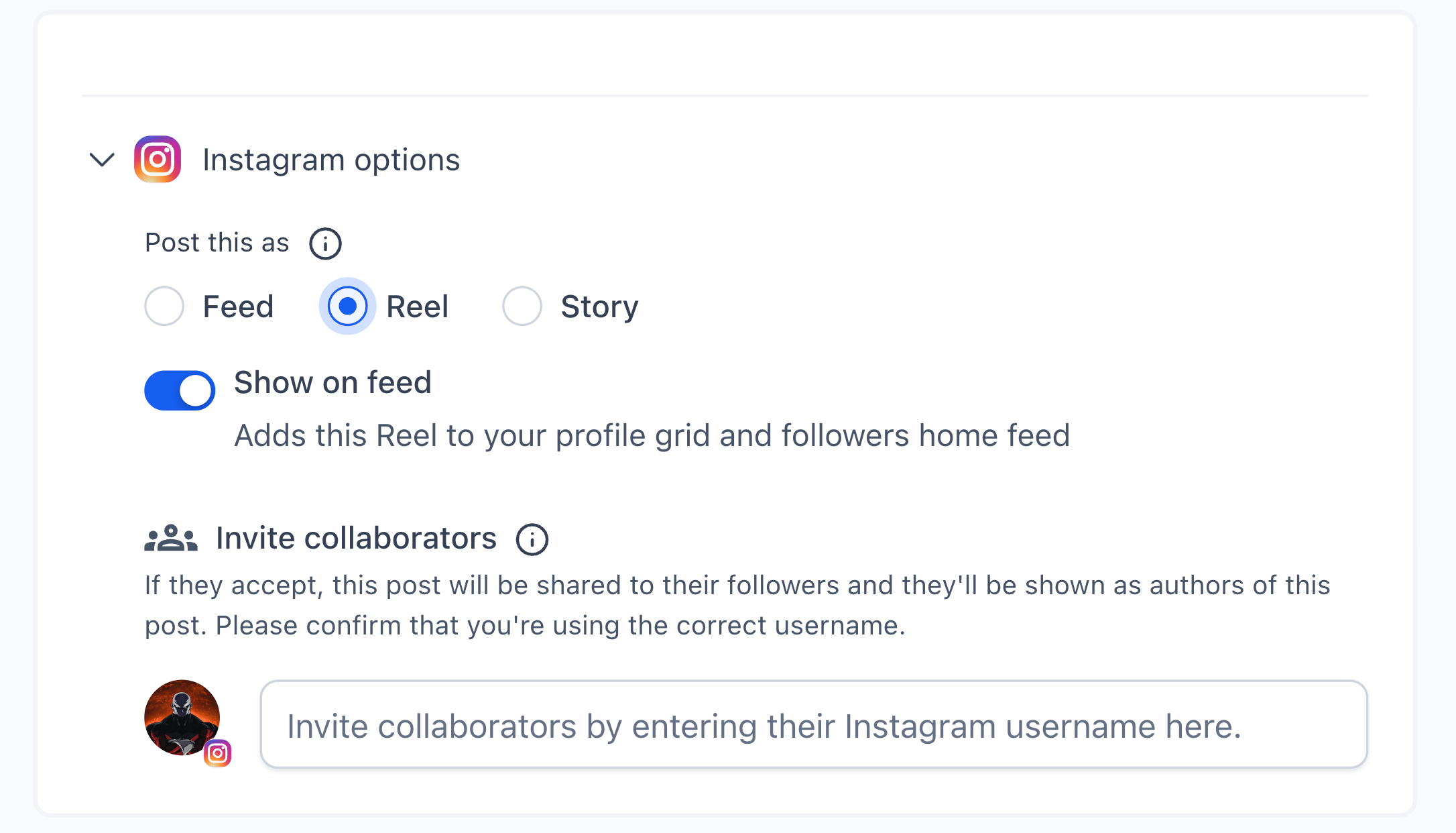

Keep Reels Off Your Instagram Grid

What Changed

Social Planner now gives you a "Show in Feed" toggle for Instagram Reels. If you don't want a Reel cluttering up your profile grid, you can turn it off when posting.

The Reel still gets published and shows up in the Reels tab. but your main IG layout stays clean.

Why It Matters for LOs

If you're not using custom thumbnails, your feed probably looks like a collection of awkward video stills. This toggle helps you stay consistent with your brand, especially if clients or agents check out your IG before connecting.

Tip: Use this feature to hide casual or short-form content from your main feed, while still gaining reach through Reels.

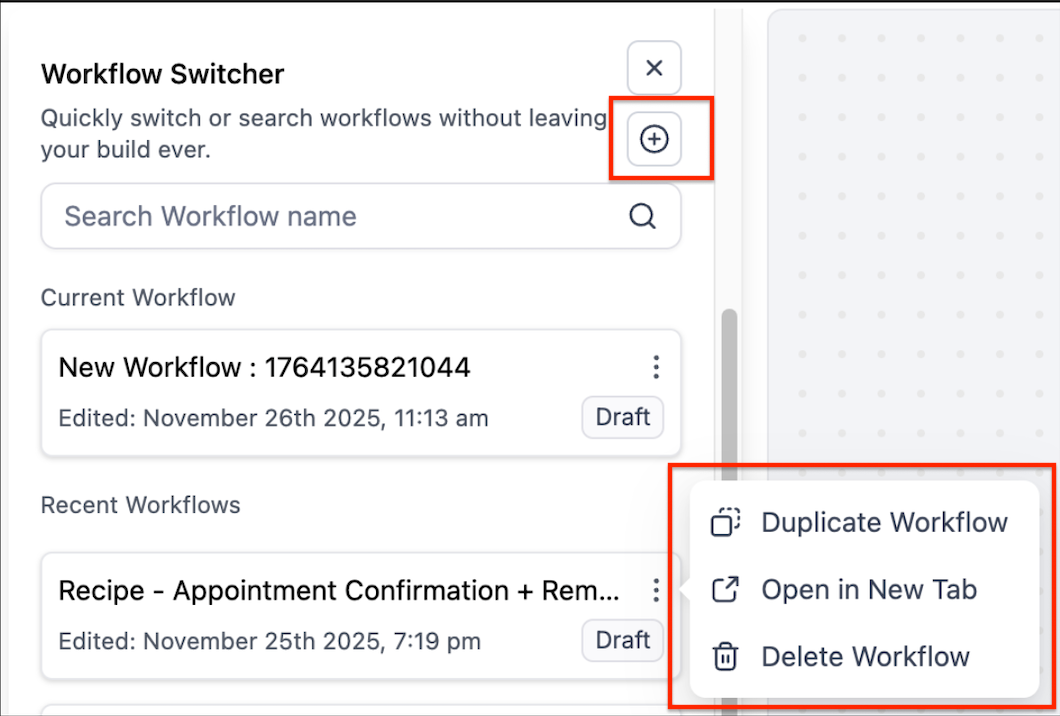

Workflow Switcher: Faster Navigation, Fewer Tabs

What Changed

The Workflow Builder now has a built-in switcher that lets you jump between workflows without opening a new tab.

Recent workflows are pinned to the top. You can scroll your entire list with infinite scroll or find what you need using the new search bar.

Why It Matters for LOs

If your lead flow includes multiple connected workflows. like lead capture, pre-qual follow-up, and long-term nurture. you probably switch between them constantly.

This update saves time, cuts tab clutter, and helps you stay focused while building or reviewing flows.

Tip: Use the "recently opened" list to bounce between related workflows without breaking your build rhythm.

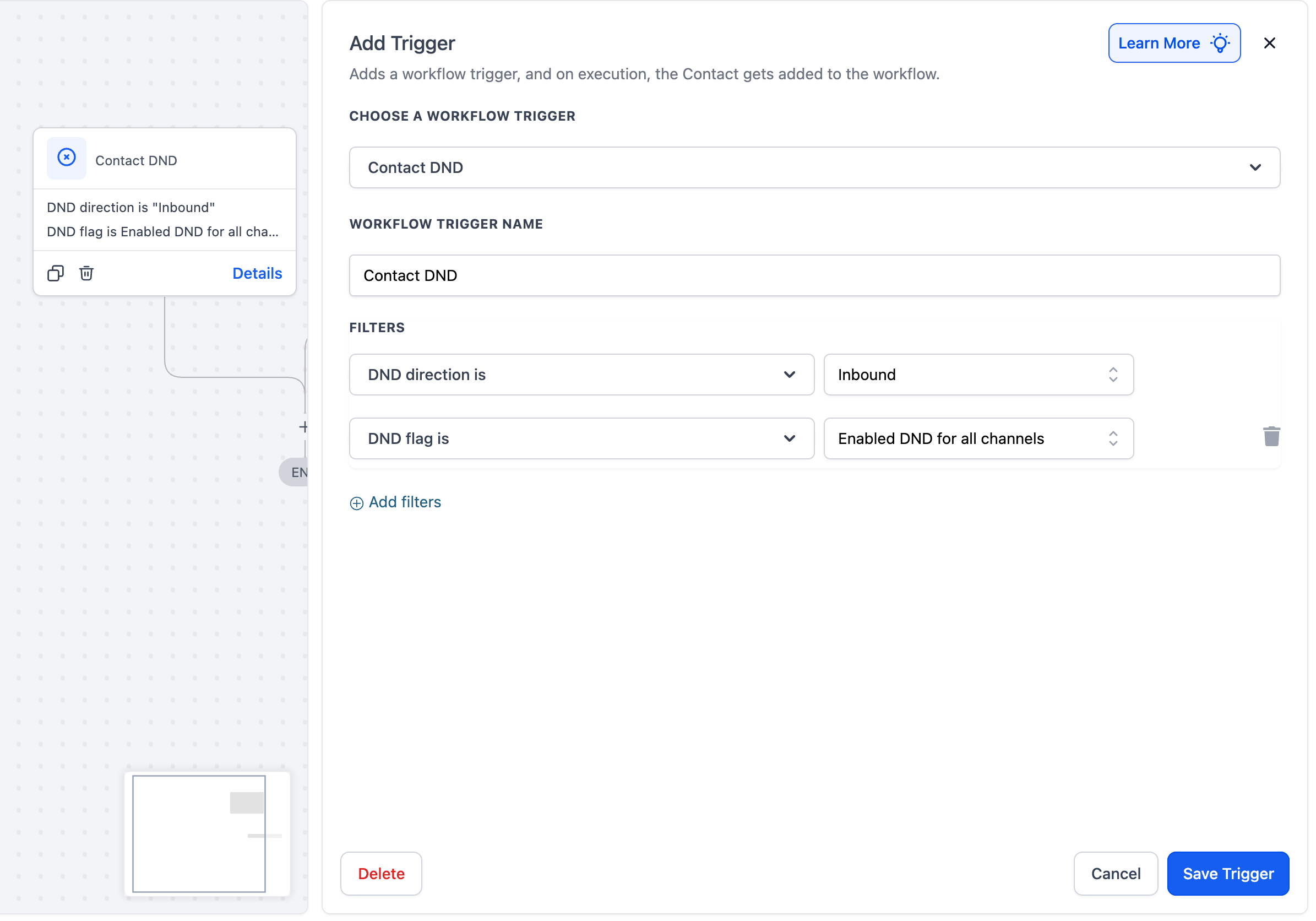

Inbound DND Now Works in Workflows

What Changed

You can now apply Inbound Do Not Disturb (DND) from inside a workflow. This was previously only possible by manually editing a contact.

Why It Matters for LOs

There are times when you want to stop communication based on behavior. like hitting a "not interested" page, replying with STOP, or flagging a contact as spam.

Now you can automate those decisions. It helps protect your number, reduce clutter in your inbox, and ensure cleaner lead management.

Tip: Add this action after unsubscribe links or low-engagement paths to keep your systems clean.

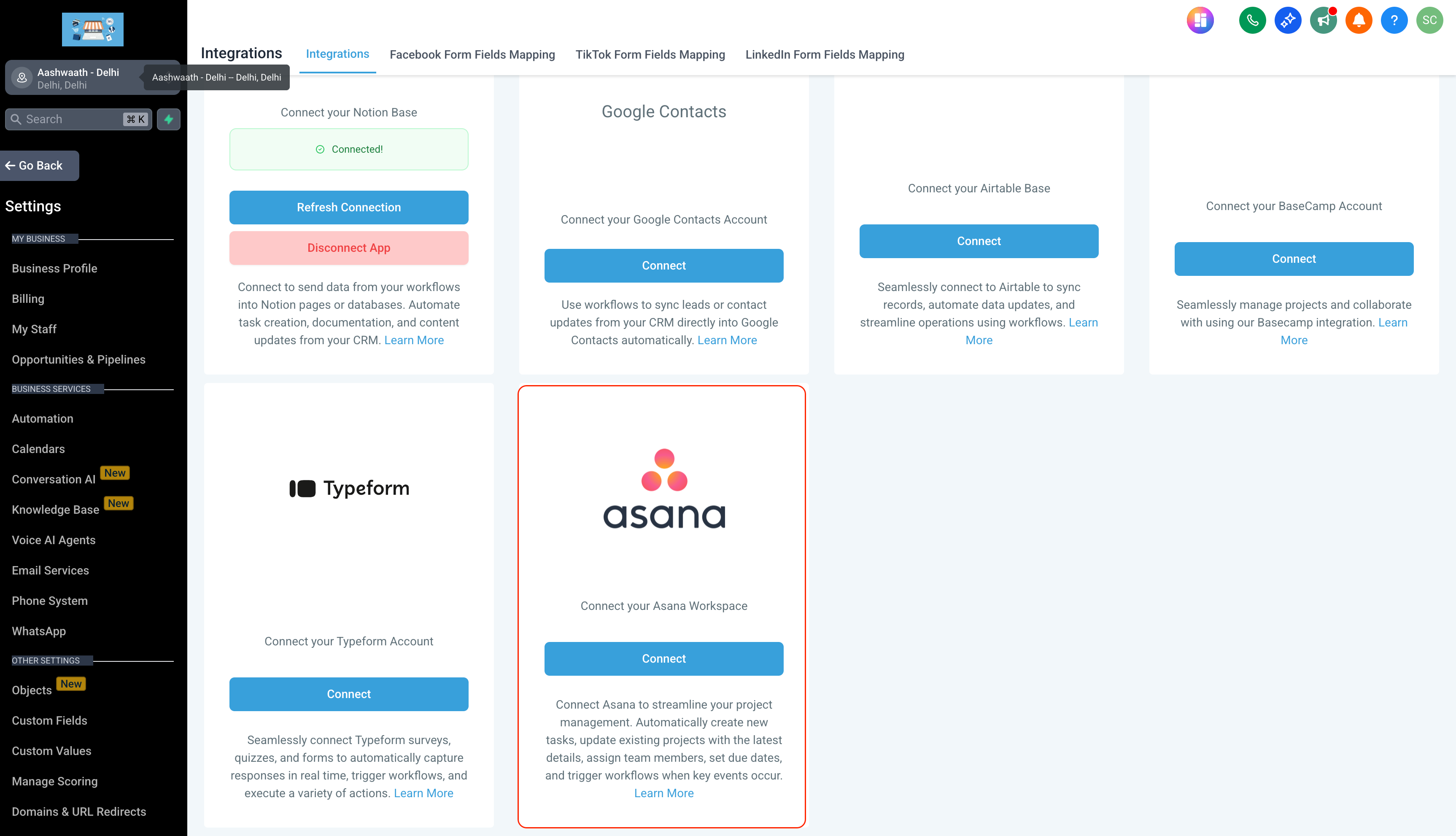

Native Asana Integration in Workflows

What Changed

Asana is now a built-in app inside the Workflow Builder. You can trigger tasks, update project boards, and automate operations without webhooks or Zapier.

Why It Matters for LOs

For ops-heavy teams tracking loan milestones, appraisals, or document collection, this unlocks direct sync between your CRM and your task system. One less tool to babysit.

Tip: Pair Asana task creation with lead stages, call outcomes, or appointment bookings to keep everything moving behind the scenes.

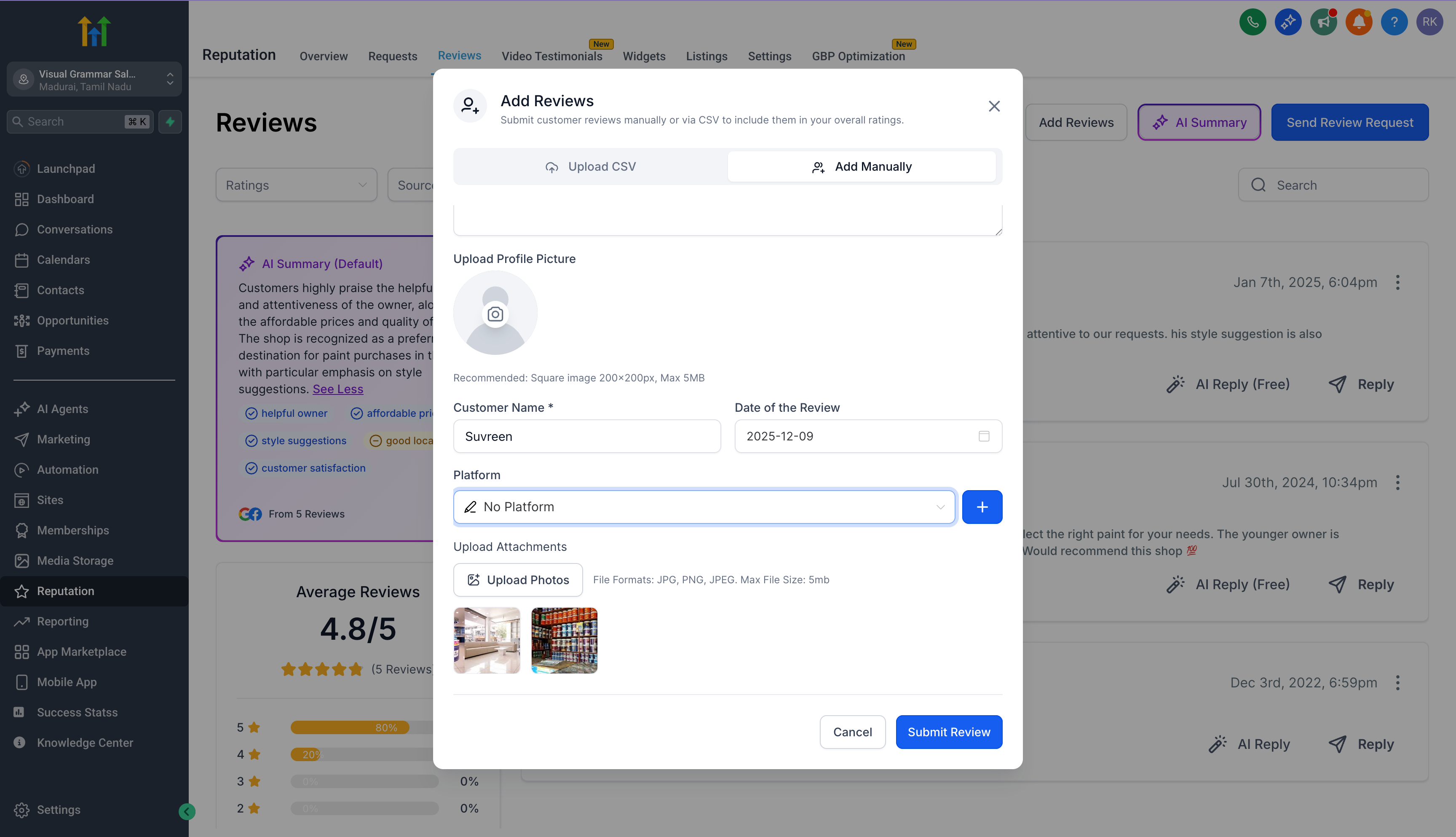

Manually Add Reviews to Reputation

What Changed

You can now manually add client reviews inside the Reputation Manager. These reviews display in your feed and widgets just like any automatically pulled ones.

Why It Matters for LOs

Not all reviews come through Google. If a borrower texts you feedback, leaves a Zillow comment, or emails a glowing testimonial, you can now showcase it without needing them to post again.

Tip: Add a profile image to manual reviews to match the visual flow of native reviews and build more trust on your site.

Why These Updates Matter for Mortgage Pros

This week's updates help mortgage pros:

Trigger workflows straight from phone calls

Run Instagram content without ruining their grid

Switch workflows without losing focus

Suppress contacts automatically

Sync loan ops with Asana

Showcase reviews from any source

These aren't show-off features. They're workhorse upgrades built for the way real users operate inside HighLevel.

Want to Go Deeper?

Join the HL4MP Community to hang out with other loan officers, see real setups, and get behind-the-scenes access to what is working in HighLevel right now. Or Go Pro for $97/mo to get hands-on help in weekly Office Hours.