This week's HighLevel updates, explained for mortgage professionals. We cut through the noise and tell you what actually matters for your business, what you can ignore, and what to set up right now.

This week's update list is short. but packed with practical wins for anyone running referral-heavy lead flows or campaign-based outreach. From cleaner associations for agent referrals to editable ad campaigns and smarter dashboard filters, each update builds on core functionality LOs depend on every day.

Let's jump in.

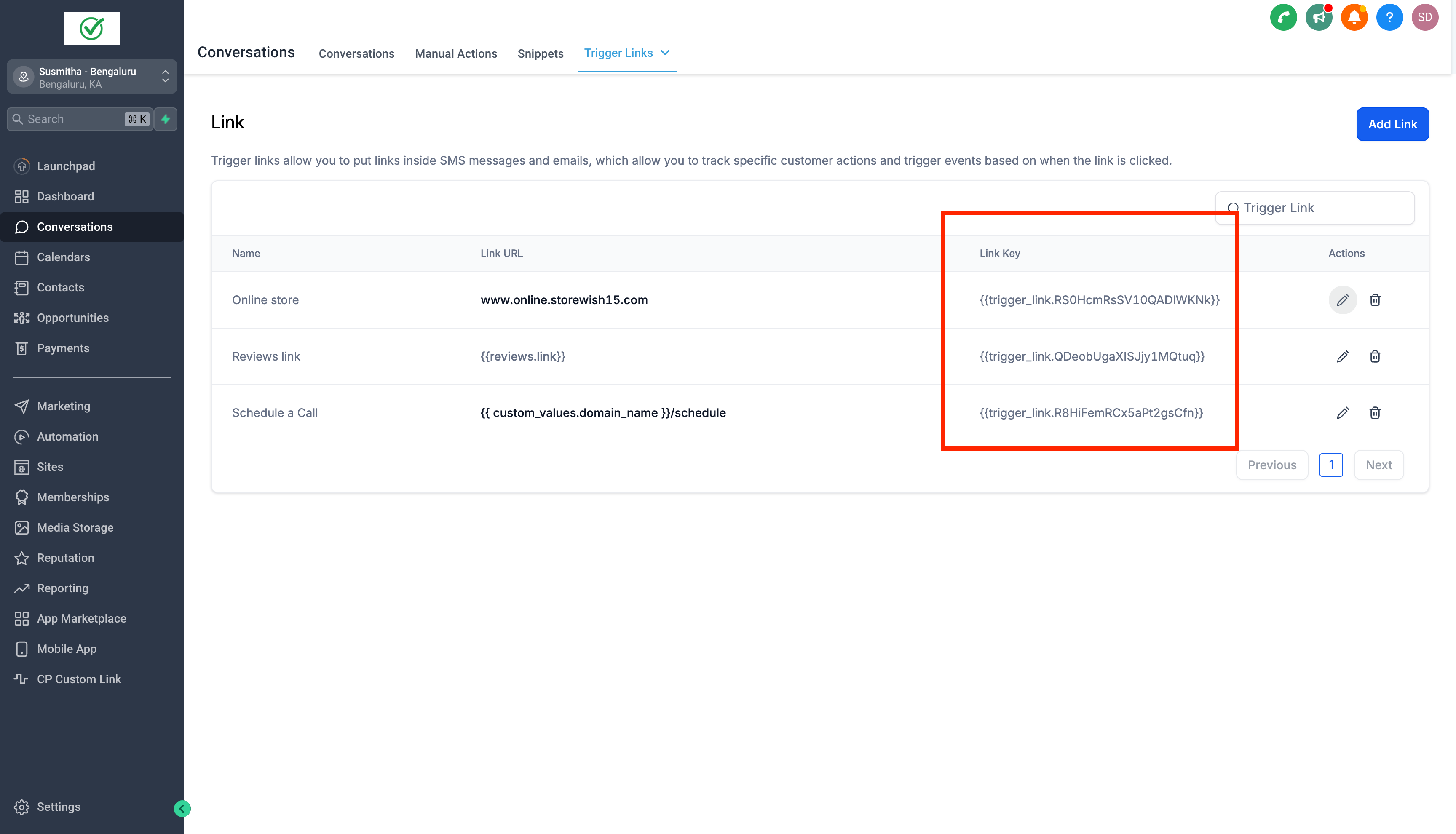

Easy Access to Trigger Link Keys

What Changed:

Trigger links inside HighLevel now allow you to copy the link key directly from the interface, instead of manually referencing a custom field.

Why It Matters for LOs:

Trigger links are one of the simplest automation tools in your toolkit. Now, they're even easier to use. great for actions like:

Tracking clicks on pre-approval forms

Notifying your team when a PDF is viewed

Triggering nurture workflows from email links

Tip:

Use this with the "Trigger Link Clicked" workflow trigger to launch actions the moment a lead interacts with your content.

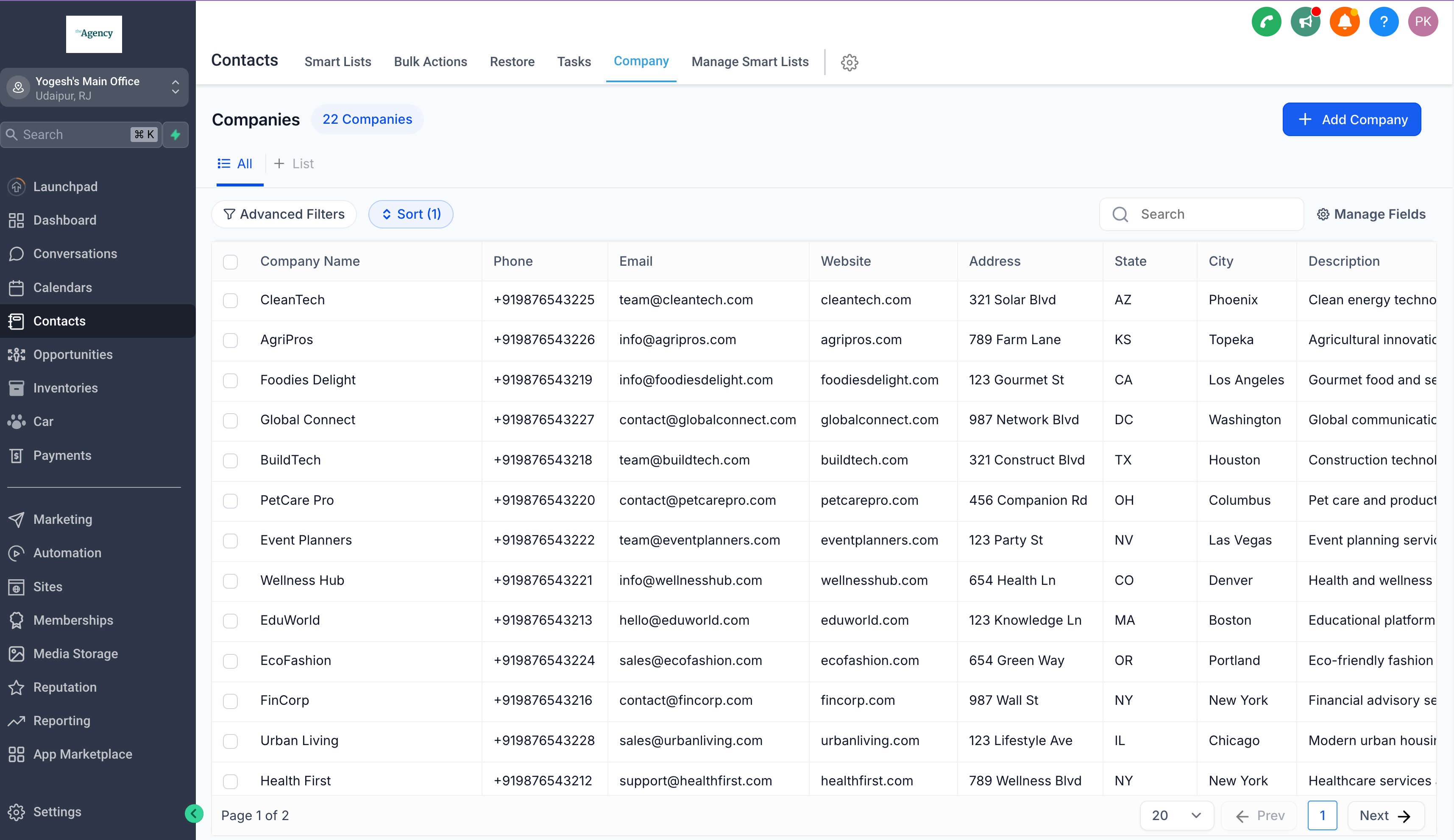

Companies Module Update for Referral Tracking

What Changed:

The Companies module has been updated with:

Support for custom fields grouped by Company

A cleaner interface for managing associations between companies and contacts

Expanded organization options in the Fields UI

Why It Matters for LOs:

You can now track real estate agent referrals more effectively. Some LOs use the Companies object as a proxy for referral partners. this update makes that easier and more structured.

Tip:

Turn on the Companies module in Labs under Sub-Account Settings. Then build fields like "Agent Type," "Referral Status," or "Brokerage Name" directly into the object.

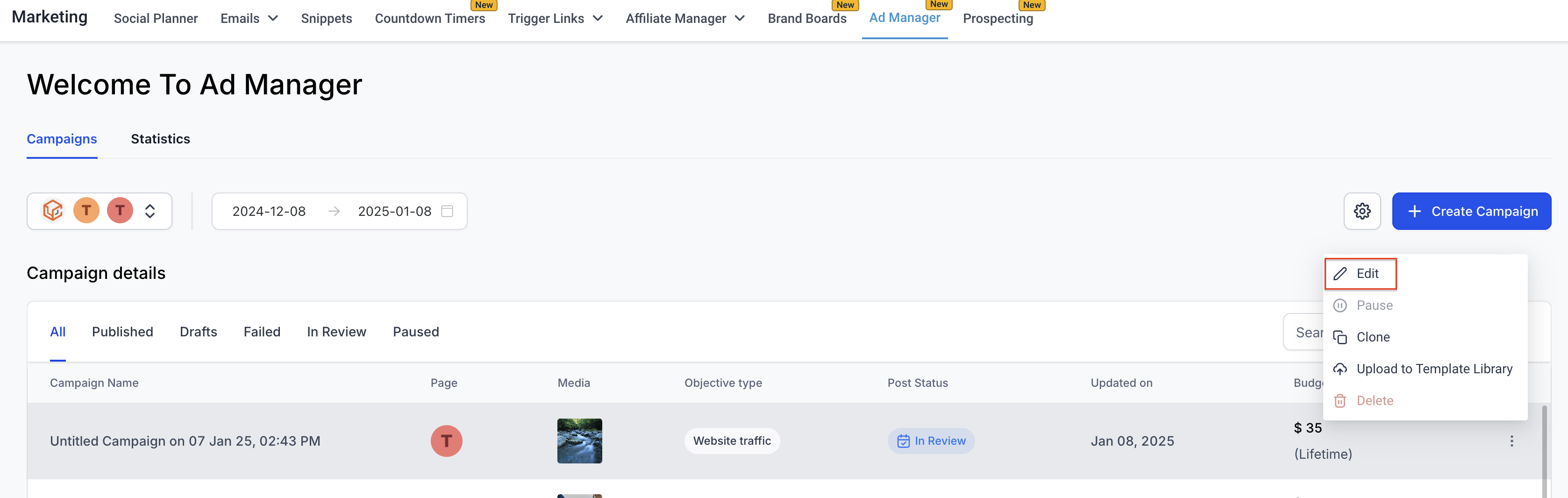

Edit Published/In-Review Ad Campaigns

What Changed:

HighLevel's Ad Manager now allows you to edit campaigns even after they're published. not just budgets, but all core settings.

Why It Matters for LOs:

Sometimes, you need to tweak messaging, targeting, or creative mid-campaign. Before, that meant pausing and starting over. Now, you can adjust without losing momentum.

Tip:

If you're actively using Ad Manager, test this feature and watch for any delays or re-approval flows (as you'd see in Facebook Ads). This gives more flexibility without full resets.

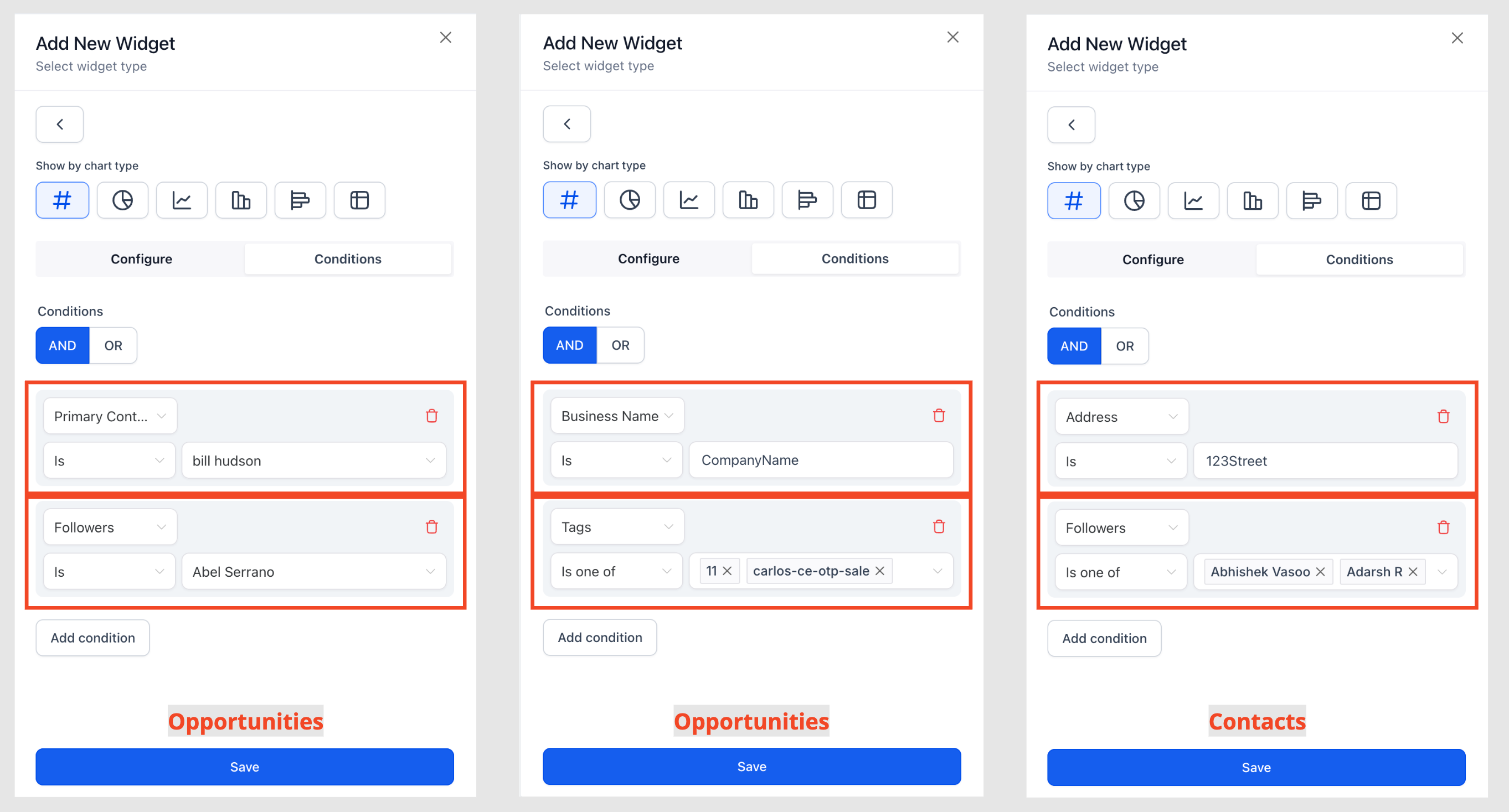

New Fields and Filters in Sub-Account Dashboards

What Changed:

Sub-account dashboards and reporting now support new fields and filter options, including:

Opportunity primary contact

Tags

Followers

Contact phone number and address

Why It Matters for LOs:

These new filter options make it easier to drill down into deal-specific data. especially for teams managing high lead volumes or multiple referral sources.

Tip:

Use these filters to fine-tune views by status, contact attributes, or tagged loan programs. The dashboard is one of the most underused power tools in HighLevel.

Why These Updates Matter for Mortgage Pros

From better referral attribution to mid-campaign agility, this week's updates sharpen your ability to take action faster:

Trigger links launch automations instantly

Companies module helps organize referral flow

Editable ads mean fewer campaign resets

Custom dashboards give better visibility at a glance

If you're focused on improving lead follow-up, referral reporting, or campaign testing, these tools are now easier to use. and more powerful.

🎥 Watch the Full Weekly Breakdown

Want to see these features in action?

Michael walks through each update with real examples and practical context for loan officers using HighLevel.

Want to Go Deeper?

Join the HL4MP Community to hang out with other loan officers, see real setups, and get behind-the-scenes access to what is working in HighLevel right now. Or Go Pro for $97/mo to get hands-on help in weekly Office Hours.