This week's HighLevel updates, explained for mortgage professionals. We cut through the noise and tell you what actually matters for your business, what you can ignore, and what to set up right now.

If you've been waiting for a week where HighLevel truly expands its ad capabilities while also cleaning up core workflows, this is it. From the ability to run LinkedIn campaigns directly inside your CRM, to hosting smarter videos and even ditching Google Analytics, this Weekly Breakdown delivers real, practical improvements.

Whether you're prospecting, building funnels, or just trying to simplify your operations. there's something here that makes HighLevel work harder for mortgage pros. Let's break it down.

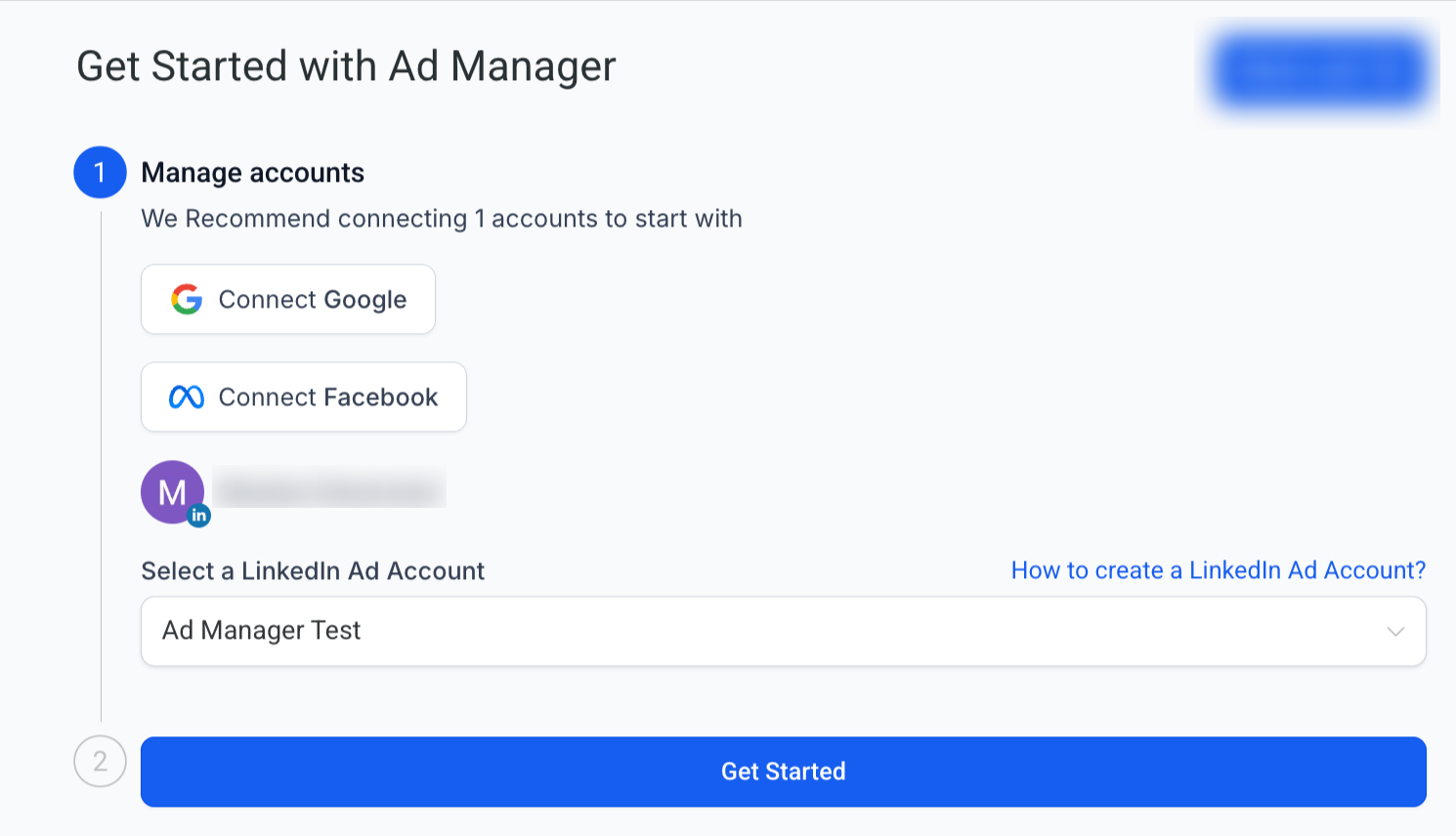

Run LinkedIn Ads Inside HighLevel

What Changed

HighLevel's Ad Manager just leveled up. You can now run LinkedIn ads directly from your CRM, joining the existing Meta and Google integrations. The interface allows you to:

Choose campaign objectives

Build LinkedIn lead forms inside HighLevel

Upload creative and copy without leaving the dashboard

Manage all ads (Facebook, Instagram, Google, LinkedIn) in one place

Why It Matters for LOs

LinkedIn isn't just for networking. it's a recruiting powerhouse and a channel for reaching niche audiences. For small teams or solo LOs, being able to launch campaigns in LinkedIn without juggling separate platforms saves time and keeps your data consolidated.

Tip

Use LinkedIn ads for recruiting loan officers or targeting referral partners. For consumer-facing campaigns, keep testing Meta and Google alongside LinkedIn to see which drives the most efficient leads.

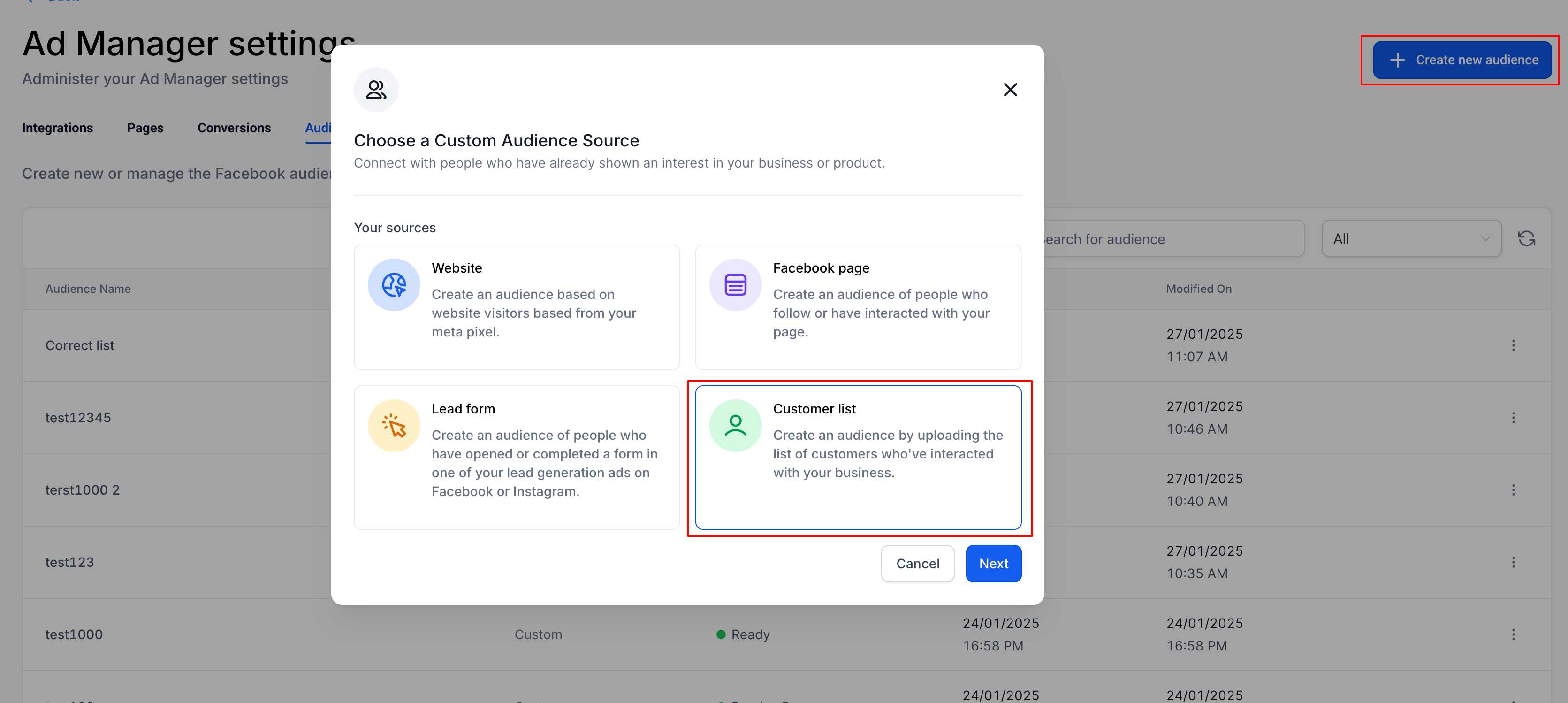

Smart List Retargeting

What Changed

You can now build retargeting audiences in HighLevel directly from your Smart Lists. Instead of exporting contacts into an external system, you can dynamically sync audience segments based on CRM data.

Why It Matters for LOs

This means:

Run retargeting campaigns for cold leads who haven't booked an appointment

Reconnect with past clients at scale

Automatically refresh your audiences as your lists update

Mortgage pros finally get a straightforward way to recycle leads without manual exports or extra tools.

Tip

Set up a Smart List for "Leads without Applications" and use it for a retargeting campaign. It's a low-cost way to stay in front of warm but undecided prospects.

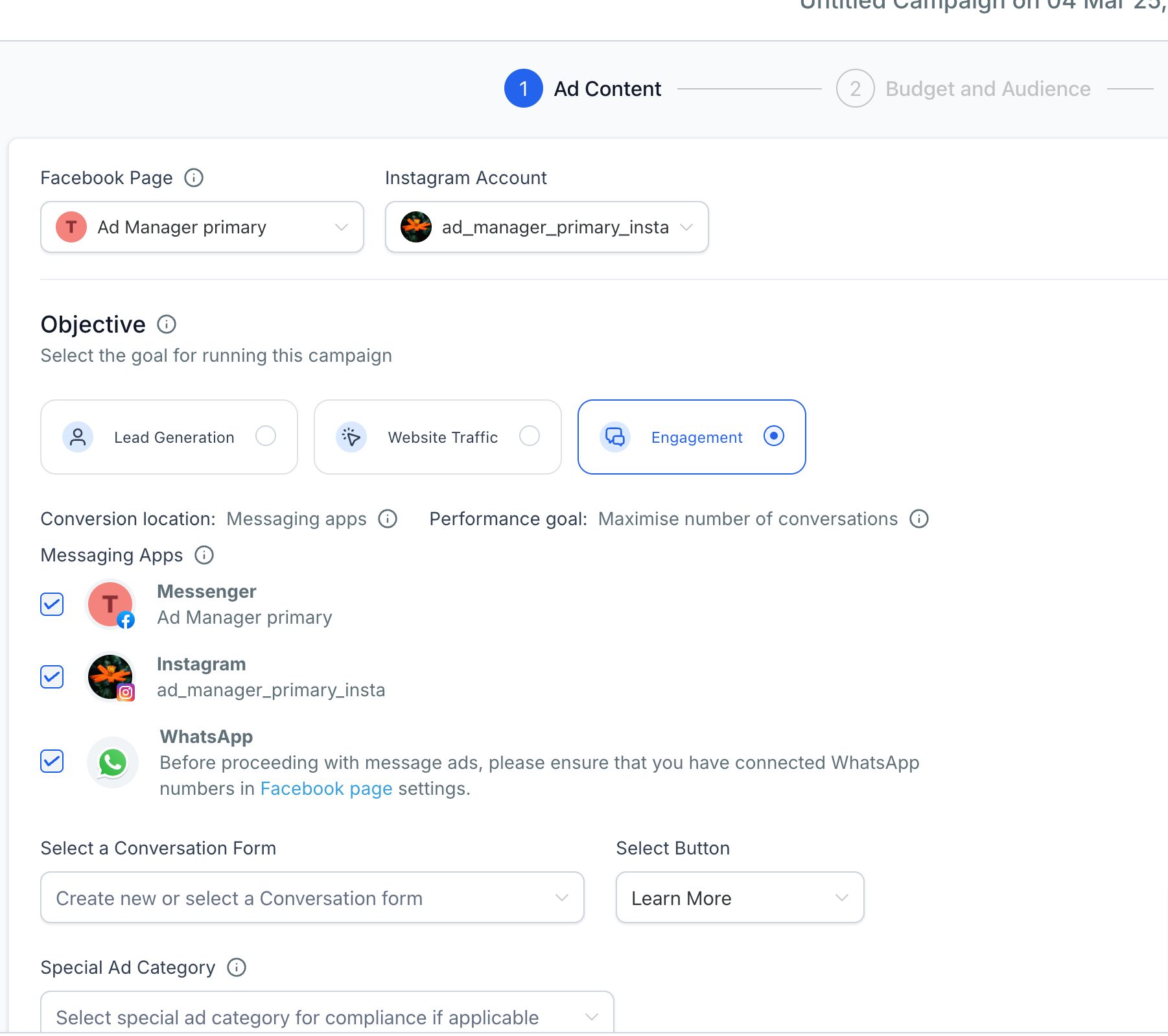

Meta Ads, Minus the Mess

What Changed

HighLevel's Ad Manager offers a cleaner interface for running Meta ads, including a built-in prompt for "Special Ad Categories" like housing, credit, or mortgage.

Why It Matters for LOs

If you've ever struggled inside Meta's own ad manager, you'll immediately feel the difference here. Mortgage ads fall under regulated categories. so having those filters upfront saves headaches and ensures compliance.

Tip

Always mark campaigns under "Housing" to stay compliant with Meta rules. HighLevel makes this clear from the start, reducing costly mistakes.

Hosted Video Enhancements

What Changed

HighLevel's hosted video element just got new features. You can now:

Loop videos continuously

Lock playback behind a form (gated content)

Customize video containers with accent colors

Adjust volume controls and playback settings

Why It Matters for LOs

Video is one of the most effective ways to build trust. With these updates, you can use video for:

Explainer videos on funnel pages

Gated training content for partners

Video testimonials that loop on your site

Tip

Try a "gated video" strategy: require name and email to watch the full video. It's a subtle way to turn educational content into a lead capture tool.

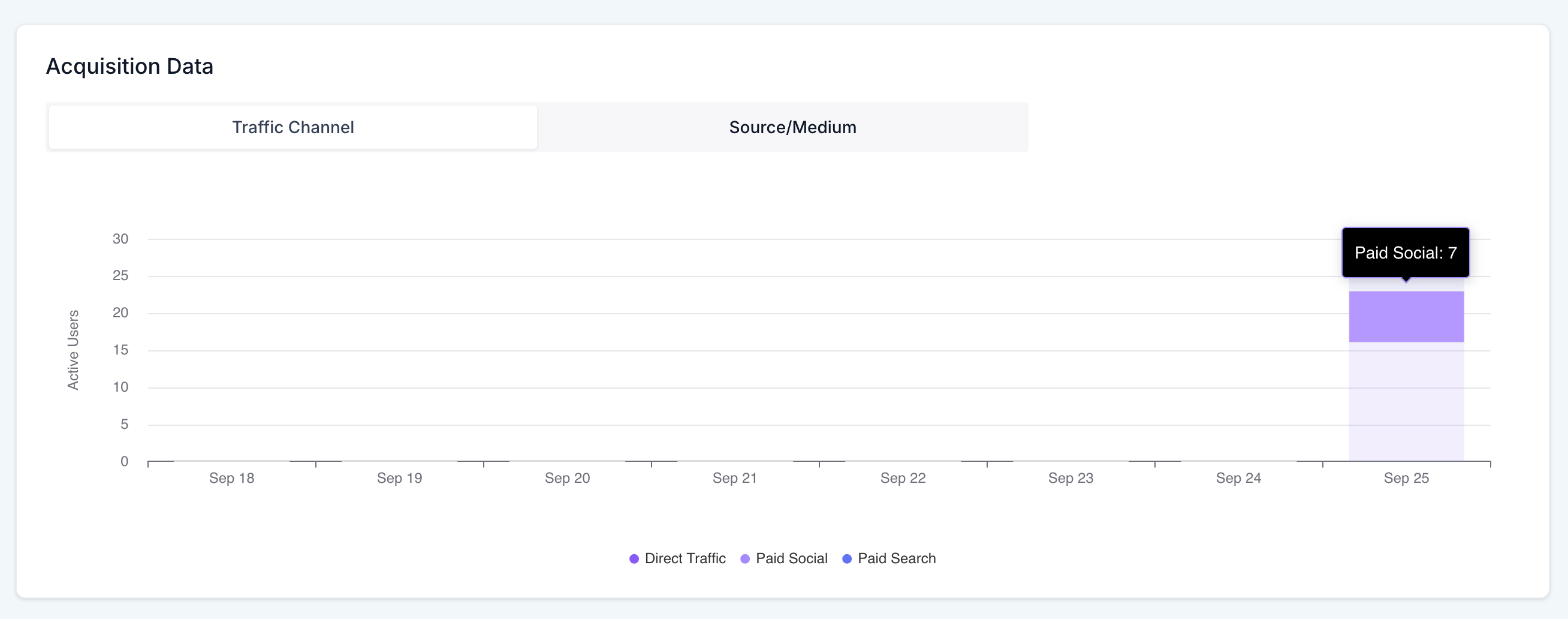

Built-In Web Traffic Analytics

What Changed

HighLevel now includes traffic analytics inside Sites > Analytics. You can see:

Breakdown by UTM parameters (source/medium)

Organic search traffic

Browser and device usage

IP addresses to spot repeat traffic

Why It Matters for LOs

This eliminates the need to log into Google Analytics just to check performance. Mortgage pros can finally:

Track funnel traffic at a glance

See which campaigns are driving real results

Spot junk traffic or duplicate visits

Tip

Add UTM parameters to your ad URLs so you can see exactly which campaigns drive the most applications or calls.

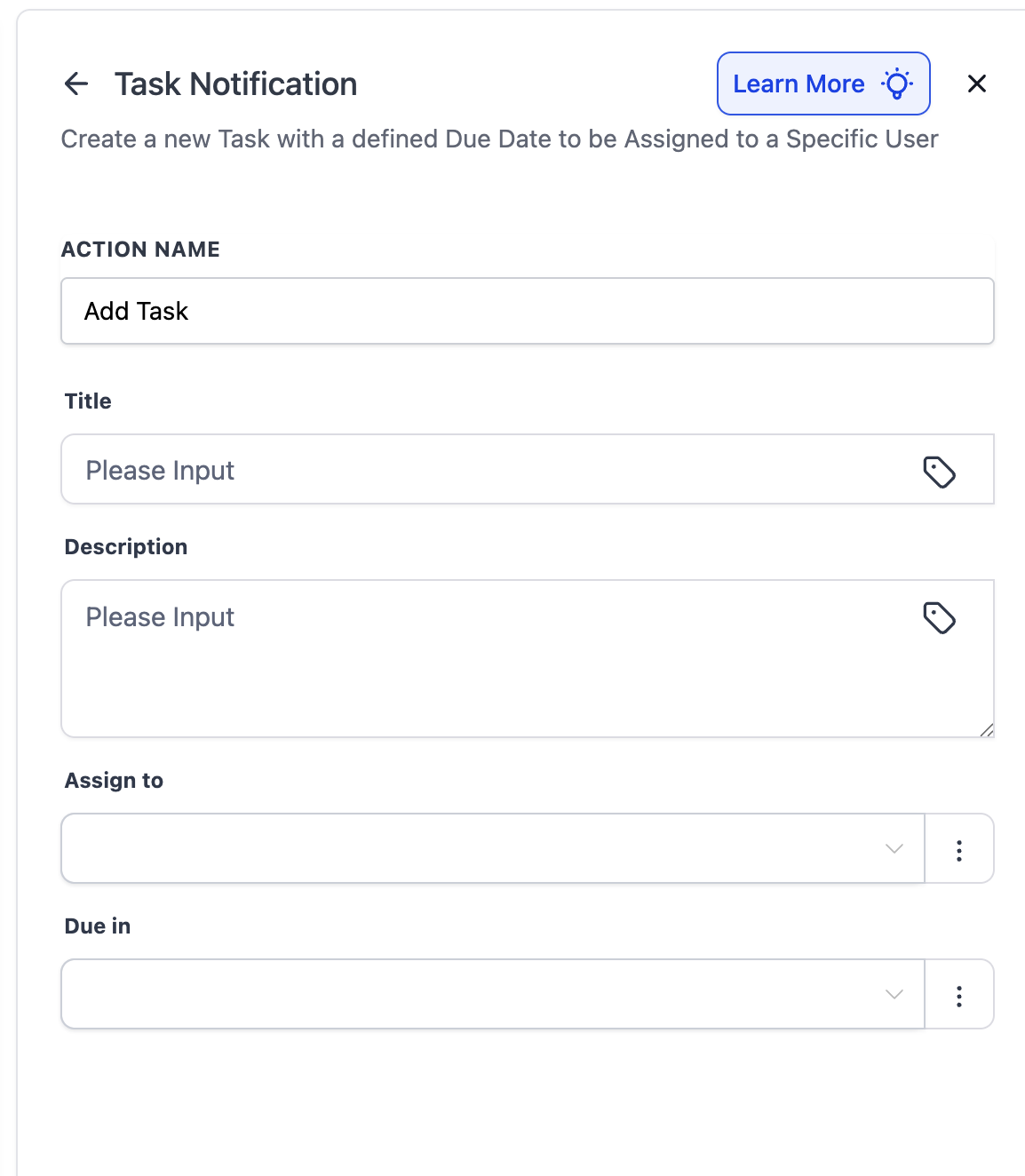

Workflow Tasks Without Contacts

What Changed

Workflows in HighLevel can now generate tasks without being tied to a contact record. Previously, every task required a contact trigger.

Why It Matters for LOs

This makes it easier to:

Automate back-office tasks (like compliance checks or monthly reviews)

Set recurring admin reminders that aren't tied to a borrower

Replace some Zapier or Make automations

It's a small shift with big workflow implications.

Tip

Set up a recurring "Team Follow-Up" task at the start of each month to ensure pipeline reviews stay on track. even if no new contacts are added.

Why These Updates Matter for Mortgage Pros

This week's updates all point in one direction: centralization. Instead of scattering tasks across ad platforms, analytics tools, and task managers, HighLevel is steadily pulling everything into one dashboard.

For loan officers, that means:

Running ads for leads and recruiting from the same place you track contacts

Capturing video leads directly in funnels without third-party players

Dropping Google Analytics and still having campaign visibility

Automating tasks that keep your back office organized

🎥 Watch the Full Weekly Breakdown

This week's upgrades aren't just about new buttons. they change how you manage ads, traffic, and daily tasks inside HighLevel. In the full video, we demo LinkedIn campaigns, Smart List retargeting, hosted video tools, and contact-free workflows so you can see exactly how to put them into practice.

Want to Go Deeper?

Join the HL4MP Community to hang out with other loan officers, see real setups, and get behind-the-scenes access to what is working in HighLevel right now. Or Go Pro for $97/mo to get hands-on help in weekly Office Hours.