This week's HighLevel updates, explained for mortgage professionals. We cut through the noise and tell you what actually matters for your business, what you can ignore, and what to set up right now.

Ready to cut friction, save clicks, and bring real conversations back into your CRM? This week's update isn't just packed. it's precision-engineered for mortgage pros looking to scale smart.

From faster workflow deployment to safer email edits and bot-to-human handoffs, the tools HighLevel rolled out this week offer real-world leverage. Let's walk through the updates that matter most for LOs and teams using HighLevel daily.

Control Labs Features From the Agency Level

What Changed:

You can now manage Labs (beta) features from the agency view. and push updates to all subaccounts at once.

Why It Matters for LOs:

Empower LO can vet, enable, and roll back features globally

No more asking individual users to toggle on Labs manually

Smoother onboarding for early access tools

Tip:

Follow Empower LO's Weekly Breakdown to know which Labs features are already tested and ready to use.

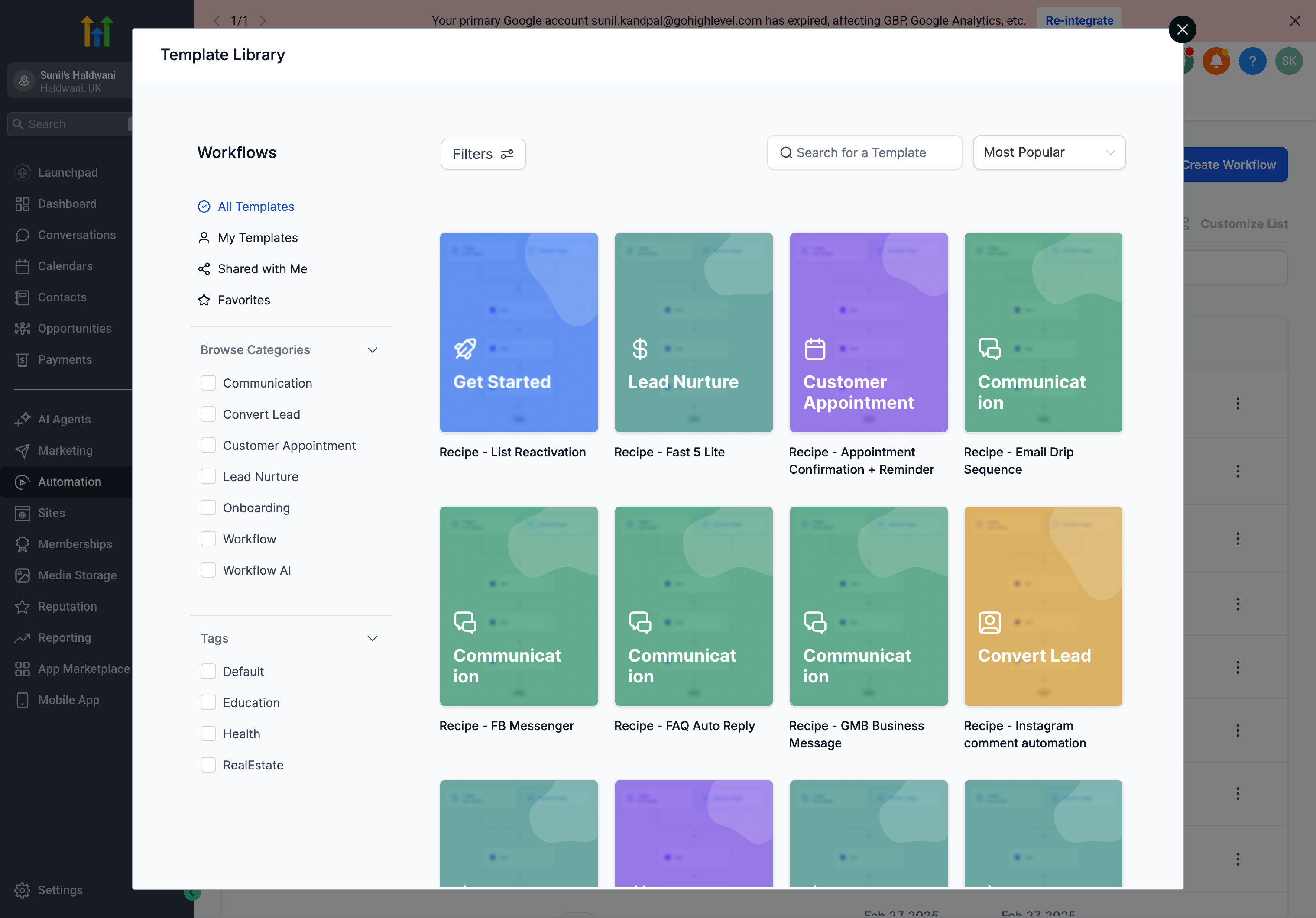

Workflow Template Library Goes Live

What Changed:

HighLevel now offers a workflow marketplace, where users can select prebuilt automations. and agencies can add their own.

Why It Matters for LOs:

Choose from curated workflows without installing snapshots

Agencies can offer a "menu" of templates without clutter

Lets LOs opt-in to tools that fit their current needs

Tip:

Use this to launch nurture campaigns, lead follow-ups, or review requests. without touching existing workflows.

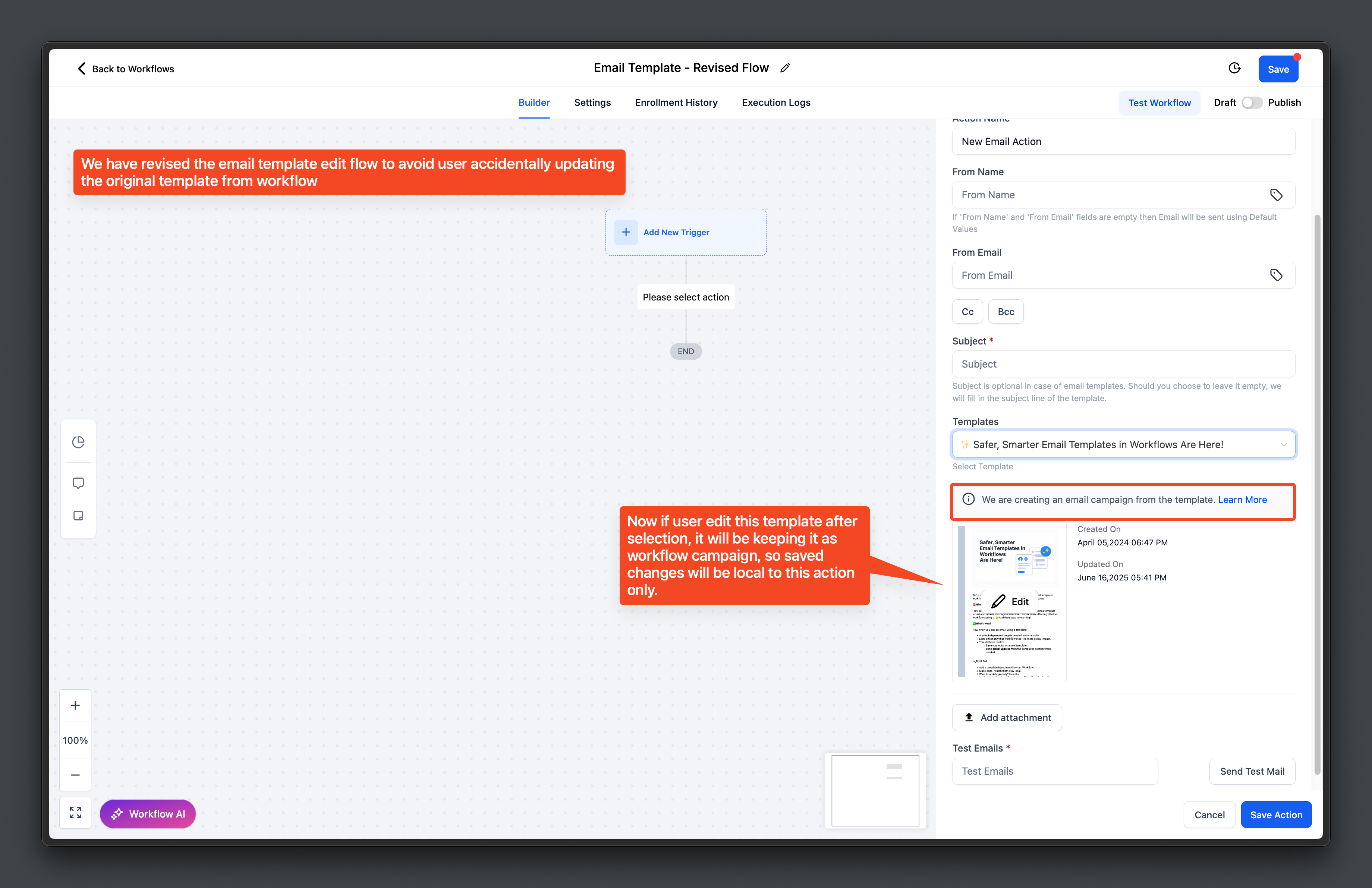

Edit Templated Emails Without Breaking Others

What Changed:

When editing an email template inside a workflow, HighLevel now duplicates the template. so other workflows aren't affected.

Why It Matters for LOs:

No more accidental edits across automations

Safer customization for team-wide messaging

Cleaner handoffs between admins, marketers, and LOs

Tip:

Use templates as a base. then personalize per workflow without hesitation.

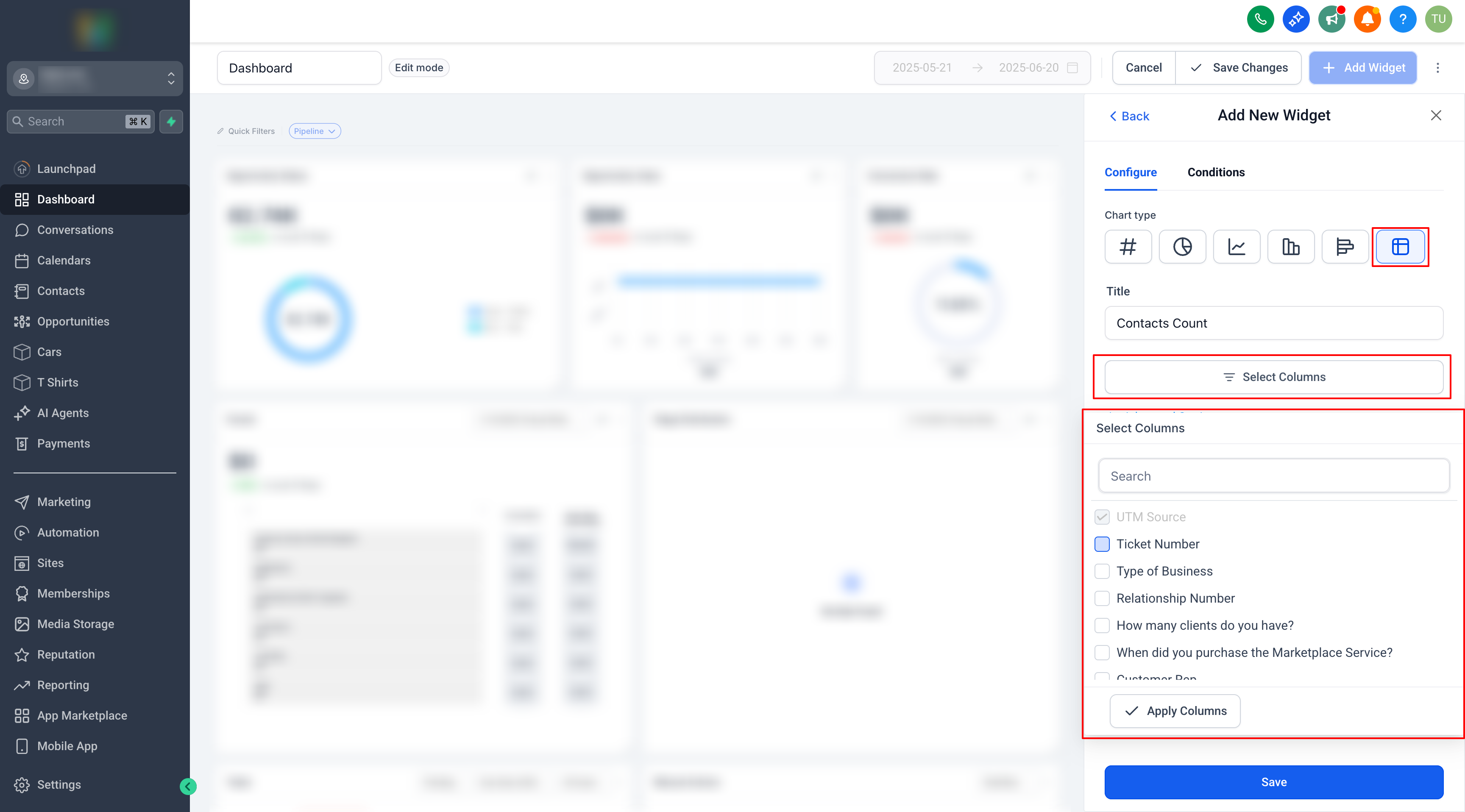

Add Custom Fields to Dashboards

What Changed:

Custom fields now display inside the dashboard's table view, unlocking more visibility over lead and loan data.

Why It Matters for LOs:

View property address, loan amount, or county directly from your dashboard

Helps managers oversee loan flow at a glance

Makes dashboard widgets actually useful for day-to-day ops

Tip:

Build dashboards that show timelines, statuses, and key lead data to help your team prioritize fast.

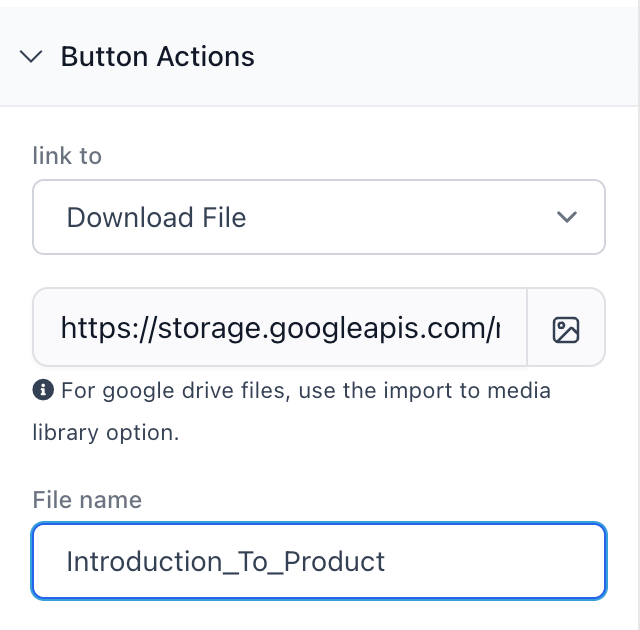

Lead Magnets With Instant Downloads

What Changed:

You can now let users download files directly from thank-you pages. no more email delays or manual delivery.

Why It Matters for LOs:

Deliver PDFs, playbooks, or checklists instantly

Reduces reliance on email deliverability

Improves mobile user experience

Tip:

Update older funnels to use direct download links. especially if your current flow relies on inbox follow-ups.

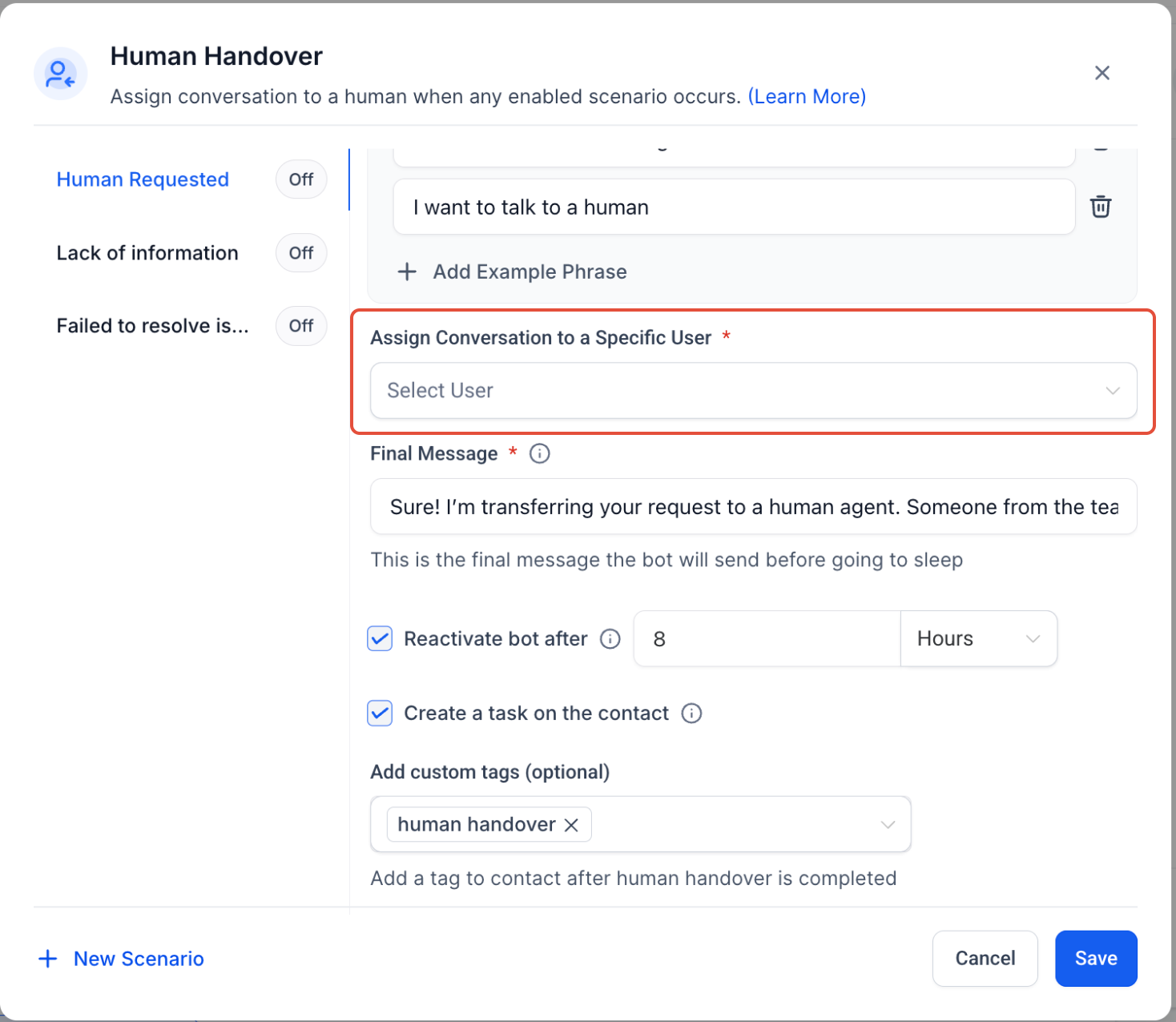

AI Chat Handover to Humans

What Changed:

Conversation AI now supports built-in "human handover" logic. no more workarounds required.

Why It Matters for LOs:

Seamlessly assign chats to a loan officer when needed

Built-in triggers for task creation and user reassignment

Helps bots feel less robotic. and more helpful

Tip:

Use AI to qualify leads, then hand off at the right moment with context intact.

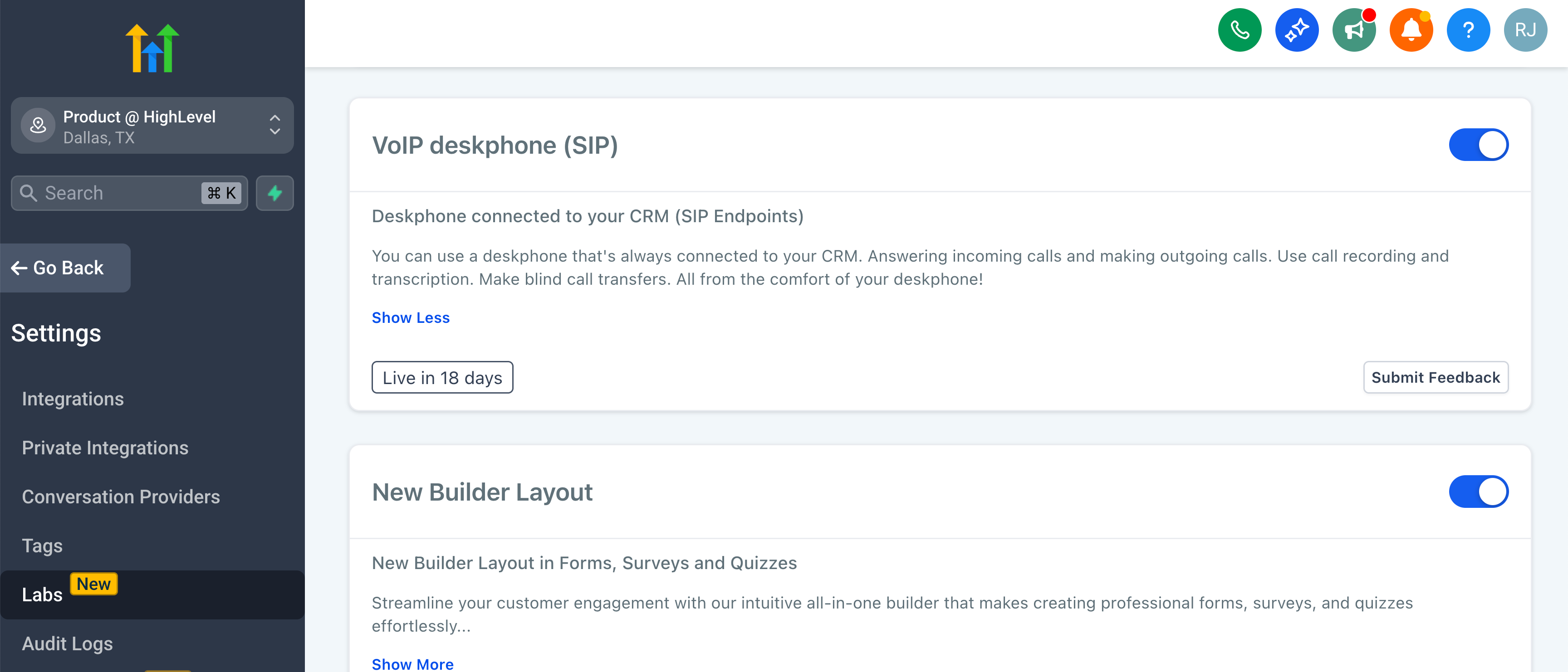

Physical Desk Phone Support Is Here

What Changed:

HighLevel now supports SIP endpoints. so you can connect VoIP desk phones directly to your HighLevel number.

Why It Matters for LOs:

Use desk phones in office setups or branch teams

Still supports IVRs and voice AI routing

Brings HighLevel full-circle as a call center solution

Tip:

Got a stack of unused desk phones? Time to dust them off and reconnect them.

Why These Updates Matter for Mortgage Pros

This isn't just another set of nice-to-haves. These updates are strategic advantages for mortgage teams:

Streamline how you deliver and test automation

Give your team faster tools that don't interrupt other workflows

Bring human connection back into AI-driven conversations

Whether you're managing lead intake, client nurturing, or day-to-day ops. these tools simplify your stack and give you control where it counts.

🎥 Want the full walkthrough?

Watch the Weekly Breakdown video for a hands-on look at what's live now. and how to use it.

Want to Go Deeper?

Join the HL4MP Community to hang out with other loan officers, see real setups, and get behind-the-scenes access to what is working in HighLevel right now. Or Go Pro for $97/mo to get hands-on help in weekly Office Hours.