This week's HighLevel updates, explained for mortgage professionals. We cut through the noise and tell you what actually matters for your business, what you can ignore, and what to set up right now.

This week's Weekly Breakdown is short, sharp, and worth your time. especially if you're running paid ads or outbound campaigns. HighLevel dropped just a few updates, but they go deep on form styling and compliance controls. two areas that directly affect how you capture leads and stay on the right side of SMS regulations.

From modern-looking checkboxes to a built-in block on texts to Texas, these changes are small but powerful. Whether you're working on conversion rates or staying compliant with new laws, this week's rollout helps you cover both.

Let's dig in.

Bubble-Style Forms and Surveys

What Changed:

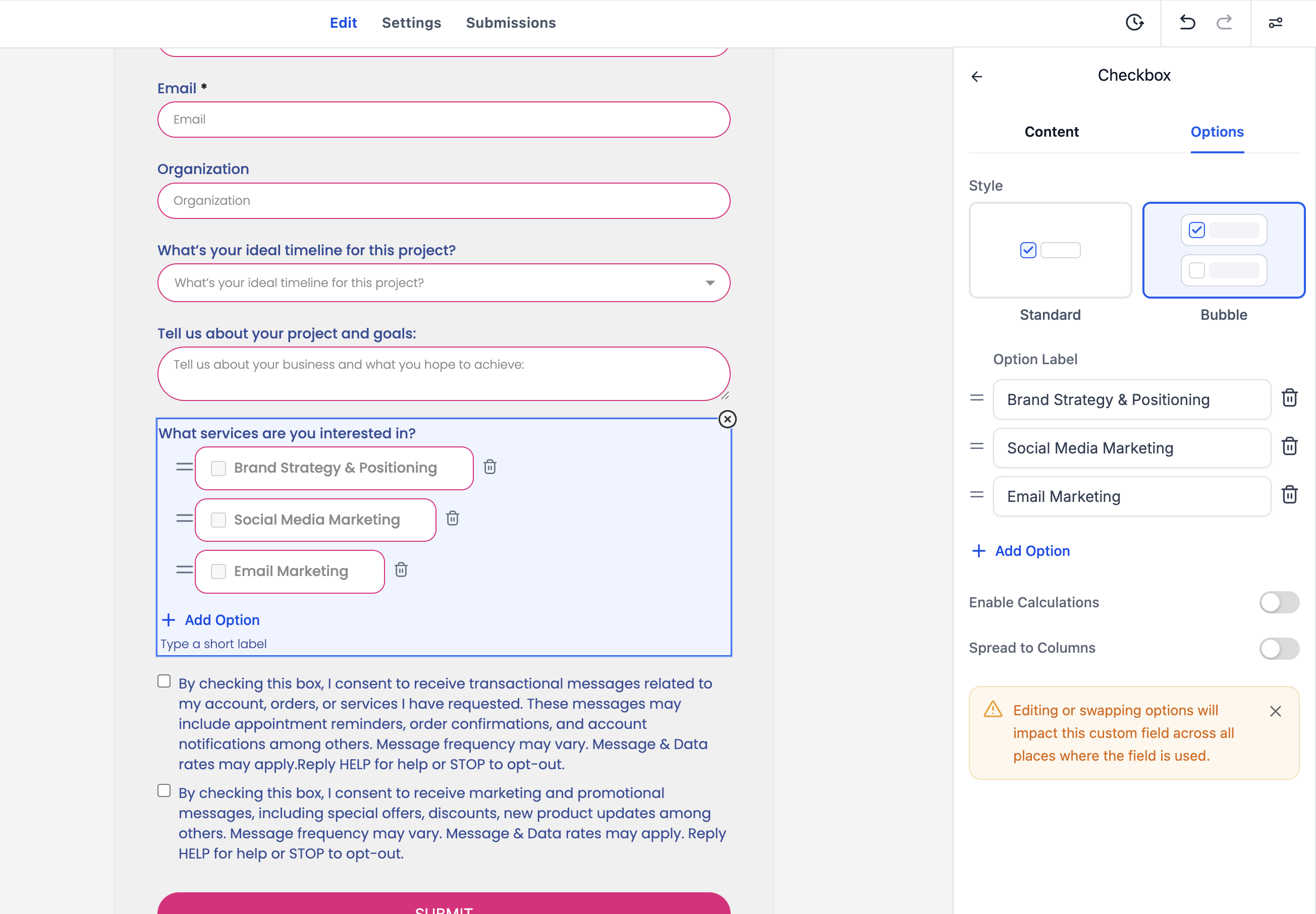

HighLevel has introduced a new "bubble" visual style for two types of form fields:

Checkboxes

Radio buttons

Instead of the traditional bullet-point or boxy layout, these elements can now appear as soft, clickable bubbles. making your forms feel more like modern web apps or landing page tools.

It's available in both Forms and Surveys, and requires no extra CSS or advanced settings. Just select the bubble style from the design dropdown inside the field settings.

Why It Matters for LOs:

Let's be real. default forms in most platforms look like 2008. That's a problem when you're paying for traffic or trying to impress online visitors. This visual upgrade helps you:

Improve mobile usability (no more hard-to-tap checkboxes)

Make multi-select fields feel like buttons

Clean up your landing pages without hiring a designer

Match your form UI to the rest of your branded funnel

Whether you're using surveys for lead routing or forms for quote requests, this makes your first impression stronger.

Tip:

Use bubble-style fields for any "choose one" or "select all that apply" type question. It's especially useful on PPC or Facebook lead funnels where visual trust signals matter.

Periodic Opt-Out Texts: Now Optional

What Changed:

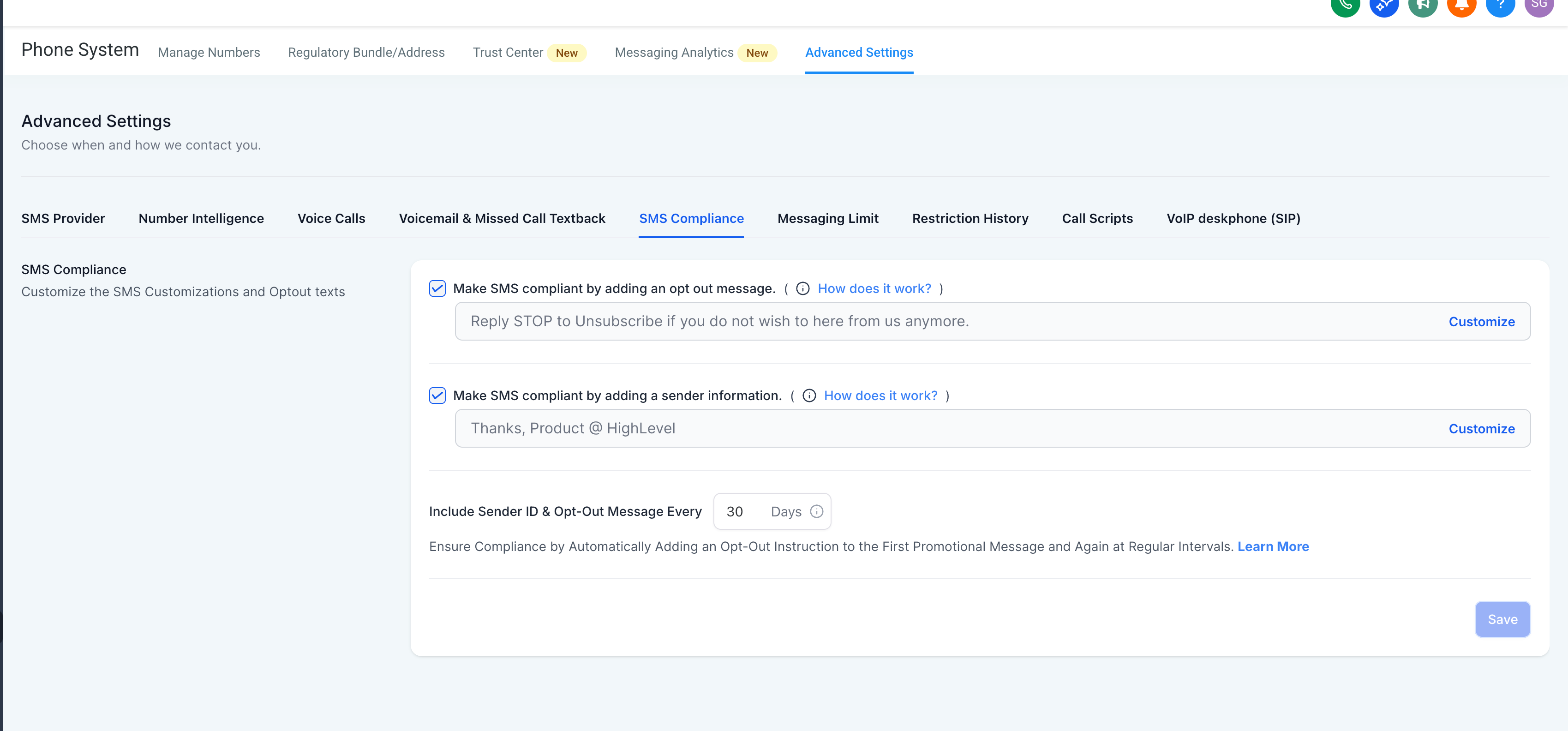

HighLevel rolled out a major improvement to how you manage periodic unsubscribe prompts in SMS workflows.

Before, every subaccount had these messages automatically turned on by default. Now, you can:

Enable or disable the feature yourself

Choose the frequency (e.g., every 30, 60, or 90 days)

It's found in Settings > Compliance, and gives users full control over when and how often these opt-out reminders go out.

Why It Matters for LOs:

Most mortgage pros aren't trying to skirt compliance. but forced messaging often hurts the flow of a good nurture sequence.

This update lets you:

Reduce friction in long-term SMS campaigns

Maintain compliance without spamming opt-outs

Tailor your messaging to your brand voice and audience

It's especially valuable if you run reactivation sequences, long drip campaigns, or event reminders.

Tip:

If your messages lean promotional or are going to cold leads, keep opt-outs on. If you're running conversational or warm nurture flows, consider spacing them out to 60-90 days.

Texas Mini-TCPA SMS Filter

What Changed:

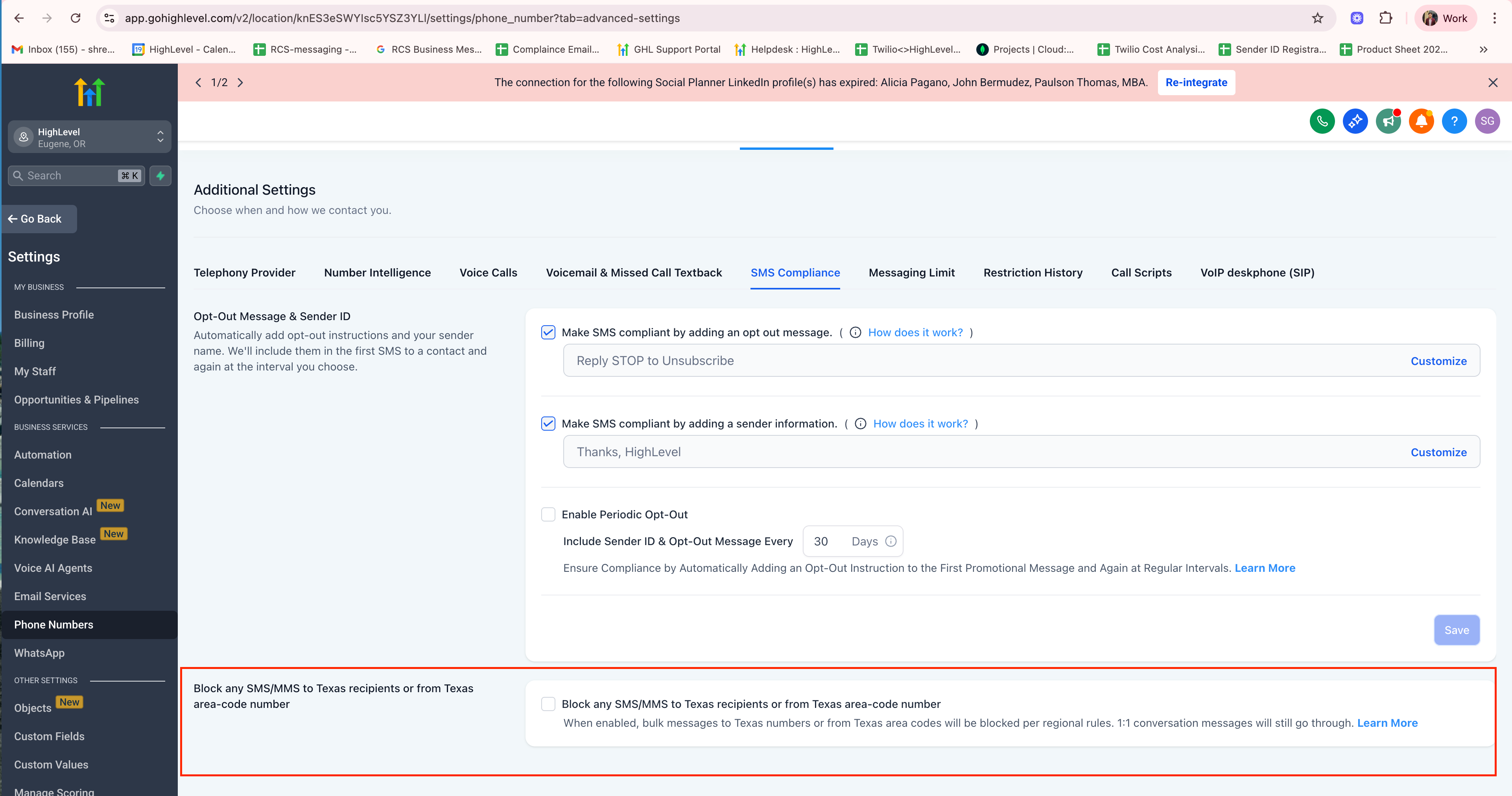

HighLevel added a new Texas-specific compliance toggle that allows you to block outbound marketing texts to phone numbers with Texas area codes.

This is in response to the Texas Mini-TCPA, a recently passed state-level law that adds stricter requirements around SMS communication. While mortgage lenders and brokers may be exempt under federal carveouts, the rule still poses a risk for large-scale senders.

When enabled, this filter:

Blocks workflow and bulk action texts to Texas area codes

Allows individual replies and transactional messages (e.g. confirmations)

The setting lives inside the compliance section and works based on the recipient's area code.

Why It Matters for LOs:

Even if you're mostly texting warm leads, any mass campaign risks falling into non-compliant territory. especially when the rules vary by state.

This toggle helps you:

Avoid legal risk while the dust settles on Mini-TCPA enforcement

Stay on Twilio's good side (and protect deliverability)

Send responsibly while still nurturing leads in other states

Tip:

If Texas is a key market for you, consult your compliance team or attorney. Until then, flipping this setting on is a low-risk way to protect your account and your brand.

Why These Updates Matter for Mortgage Pros

This week's updates might be few, but they go straight to the heart of how you:

Present your brand through forms and surveys

Maintain trust and control in your texting campaigns

Stay safe while laws shift around SMS and marketing

HighLevel is clearly investing in the details that protect your time, leads, and reputation. and these features prove it. Whether you're a solo LO or running a multi-agent team, these upgrades help you stay modern and compliant without adding friction to your funnel.

🎥 Watch the Full Weekly Breakdown

These updates may sound simple, but the power lies in the execution. In the full video, we walk through exactly how each integration works and give you ideas for how to apply them to your lead flow, task management, and more.

Want to Go Deeper?

Join the HL4MP Community to hang out with other loan officers, see real setups, and get behind-the-scenes access to what is working in HighLevel right now. Or Go Pro for $97/mo to get hands-on help in weekly Office Hours.